SyndicateRoom’s aim is to finance great British companies throughout their entire funding journey. With around 70 per cent of the companies that it accepts raising all the funds they need and its EIS fund, Fund Twenty8, automatically adding additional investment for qualifying opportunities, raising funds with SyndicateRoom could be a good choice for high-quality companies with a strong management team.

A bit of background

Launched in 2013 as an equity crowdfunding platform, SyndicateRoom rapidly grew into a sophisticated online equity investment platform spanning the full spectrum of investment opportunities, from private S/EIS rounds to IPOs and placings on the LSE. Along the way, it has been recognised through numerous industry titles, from Best Investment Platform to Industry Game-Changer.

To date, SyndicateRoom has helped more than 100 companies raise over £87 million – that’s about 70 per cent of the companies that list on SyndicateRoom. In comparison, other platforms typically have a success rate of ~40 per cent, the company claims. Already, SyndicateRoom’s portfolio has seen one exit (via acquisition), while 97 per cent of our portfolio companies are still trading; the industry average is 75 per cent.

Here’s how you can get involved in the platform.

Private markets and the investor-led model

SyndicateRoom members are able to invest in unquoted companies in exchange for equity alongside active professional investors, including business angels and VCs.

The platform operates on the investor-ledTM model where, on a £1-per-£1 basis, all investors (big and small) would make or lose the same amount of money, sharing the risk and reward fairly.

It means that, in addition to meeting certain criteria, each private investment opportunity is led by an experienced investor who carries out their own due diligence and negotiates the terms of each deal for themselves and our members, resulting in a much fairer and more attractive valuation for smart investors. It’s this model that enables SyndicateRoom to list companies of all stages, from all sectors, without compromising on quality.

The members

To register as a member of SyndicateRoom and gain access to private opportunities, investors must self-certify as either high-net-worth individuals or sophisticated investors. As a result, the company has a very diverse investor base, with members varying from very experienced business angels (including some of the ten business angels all entrepreneurs should know) to lawyers, accountants and other professionals.

Some of these investors would certainly identify as active business angels, who tend to play strategic roles in their portfolio companies and get very involved; others are happy to offer their skills or network of contacts, while others still prefer a more passive approach to investing, while taking advantage of any EIS/SEIS tax reliefs on offer.

As the minimum investment amount for private deals on our site is currently set at £1,000, members are very discerning about where they put their money – it’s why ~97 per cent of the SyndicateRoom’s portfolio companies are still trading and why we’ve already seen one company exit in such a short space of time.

Sector agnostic

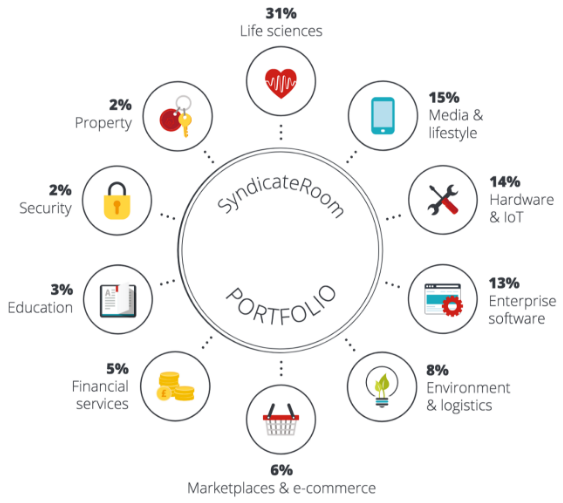

While the platform is ‘sector agnostic’, approximately one third of the companies that raise funds on SyndicateRoom belong to the life sciences. The company says it has consistently been the most active platform in Europe for the life sciences.

The following chart gives a taste of the portfolio’s sector distribution.

SyndicateRoom says it is privileged to have worked with companies that are making a real difference to people’s lives, from stem-cell creation to global recycling solutions to diabetes treatments that can literally save you an arm and a leg.

And this idea of helping fund companies that are striving to make the world a better place extends beyond the sectors of medtech and greentech. The company recently worked with Boudica Indigo, a film production business that has launched the first European initiative to redress historical gender disparities on and off screen. Squirrel, another portfolio company, is a financial management and savings solution that helps people regain control of their finances. Ethical fashion line Beulah London creates elegant, luxury womenswear items while operating the Beulah Trust, a charitable foundation that supports projects and initiatives that create sustainable livelihoods for victims of human trafficking.

Think your business would fit well in its network of prestigious portfolio companies with a conscience? Keep reading to see how you can get involved.

What companies are eligible?

In order to list on the SyndicateRoom platform, companies must meet certain criteria. Broadly, these are as follows:

- Your business should be incorporated in the UK or Ireland

- At least 25 per cent of your total funding target must already be committed as lead investment, ie a significant amount of your funding round must have already been negotiated and committed

- The round size must be £150,000 or greater

- You must offer investors the same price per share and class of share as others in the round.

If the above resonates, you can visit the ‘Raise with us‘ page and fill in the short form to get the ball rolling.

Don’t meet the above criteria? The company might still be able to help, now or in the future. Get in touch at entrepeneur@syndicateroom.com and reveal a little about your venture; and the platform will take it from there.

How it works

If you fit the criteria, SyndicateRoom will review your business plan and present your company to its investment committee, who will make sure there is a good fit between the company and the platform. If you’re successful, the platform will work with you to prepare your pitch and develop an appropriate marketing campaign and, once your posting goes live on SyndicateRoom, the company will promote it to its network of sophisticated investors.

Fund Twenty8

In addition to direct investor support, EIS-qualifying opportunities that raise successfully on the platform automatically receive investment from the £4.5 million HMRC-approved fund, Fund Twenty8, which invests proportionally alongside platform investors, giving you the potential to double the amount raised from SyndicateRoom investors.

Fees for listing with SyndicateRoom

Companies pay a 4 per cent commission plus a banded monthly fee on funds raised from SyndicateRoom investors, together with a £1,500 setup fee; 0 per cent will be charged on money raised from investors that companies themselves bring to the round.

The banded monthly fee (minimum £125) is dependent on the amount of investment received from SyndicateRoom investors and begins on the closure of a successful round. This payment ceases to apply on a company exit (IPO or whole business sale).

This monthly cost means that your company keeps more of the capital raised at a time when you need it most, and are able to spread your payments to make them more manageable. It also covers, amongst other things, the continued maintenance and work of the nominee.

There are no upfront or ongoing charges to investors.

The SyndicateRoom nominee

SyndicateRoom operates a nominee structure. This means it groups together all individual investments and they are held through a nominee, helping manage the administrative burden for you and the investors. While the SyndicateRoom nominee is the legal owner of the shares, investors remain their beneficial owner and retain full economic rights to them.

In practice, the nominee focuses the flow of communication between investors and the companies in which they invest, resulting in a faster and more efficient process. You can learn more about how it works in this FAQ.

That’s the outline crash course of how SyndicateRoom’s private markets offering works and what you can do to get involved.

Ready to give it a go? Visit the Raise with us page and fill out the form to see how you can work with SyndicateRoom.