UK SMEs are planning to increase investment levels over the next three months as developing and securing new talent becomes top priority, according to the latest SME Confidence Tracker from business funder, Bibby Financial Services (BFS).

The latest findings show that SMEs owners are planning to invest £88,721 in Q1 2018, up 14 per cent on planned expenditure for Q4 2017 (£77,813).

Four in five SMEs (80 per cent) invested in their businesses in the final three months of the year, with two fifths (41 per cent) investing in upskilling existing staff.

This trend is set to continue in 2018 as more than a third plan on to invest in staff training and development.

The research also finds:

- More than a quarter (28 per cent) plan to hire new staff between January and April

- Investment in digital technology and IT (28 per cent), developing new supplier relationships (27 per cent) and new equipment or machinery (23 per cent) also feature as key investment areas

- Rising costs (18 per cent), increased competition (16 per cent) and lack of skilled staff (12 per cent) are key concerns.

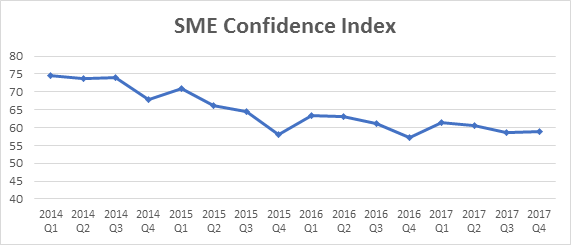

The latest investment figures come as confidence amongst SMEs edged-up in Q4, with 37 per cent reporting sales growth in Q4, up from a third (33 per cent) in Q3 2017. BFS’s SME Confidence Index shows confidence increasing from 58.7 in Q3 to 58.8 in Q4 2017.

Commenting on the findings, Edward Winterton, UK CEO of Bibby Financial Services says, ‘While confidence among small businesses remains low, there does seem to be light at the end of the tunnel, with SME owners now starting to think about investing for the future.

‘However, while there are signs that confidence is edging back, it remains to be seen whether this is sustainable.

‘Nevertheless, businesses are not resting on their laurels but backing their own business as best way to capitalise on new opportunities.’

Discussing continuing uncertainty for UK SMEs, Winterton continues, ‘Uncertainty in the UK economy and Brexit remain key concerns for businesses and both continue to impact investment levels among small businesses.

‘A number of significant issues pertinent to SMEs remain, such as the potential upfront payment of VAT on goods imported from within the EU and the UK’s membership of the customs union.

‘Such issues continue to plague SME plans for the future and stifle confidence in the wider economy. Add to this the economic impact of the Carillion crisis on SMEs and supply chains throughout the country, it is likely that we will see this chronic uncertainty continue further into 2018, despite some green shoots at the end of last year.’