Despite financial fraud soaring, seven in ten businesses leaders and managers (69 per cent) admit they have not taken any action to protect their business and employees, new research from Financial Fraud Action UK (FFA UK) reveals.

The research finds that almost half of business leaders (48 per cent) have little to no concern about falling victim to financial scammers, with half (49 per cent) believing it is unlikely to happen to their business.

This is despite the fact that more than a quarter of businesses (28 per cent) admit they have already fallen victim to a financial scam or have experienced attempted scams in the past two years.

Fraudsters take advantage of a lack of knowledge

The most common targets for fraudsters are senior management and business owners in SMEs (67 per cent) and employees in large companies (40 per cent). Common business scams include invoice fraud, where a fake invoice or bill is sent to a company requesting payment for goods or services, and CEO impersonation.

More than three quarters of business leaders (77 per cent) admit that they have never heard of the impersonation technique, where fraudsters send a spoof email purporting to be from a senior representative of the company requesting a payment to a new account.

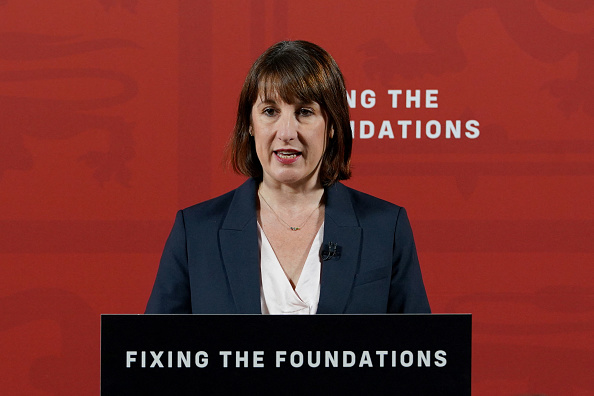

Katy Worobec, director of FFA UK, warns that both business leaders and employees need to be more vigilant and aware of fraudster tactics.

She adds, ‘Fraudsters will often use spoof emails to impersonate a senior member of staff to deceive employees into transferring money. They also pose as a regular supplier to the company and make a formal request for bank account details to be changed. This can happen to any business on any scale.’

Worobec continues, ‘It is particularly concerning that many businesses haven’t spoken directly to employees about how to spot and deal with scams. This means they are potentially exposing their business to significant financial loss.’

Ronan Quiqley, executive director of corporate services at the British Chambers of Commerce (BCC), says, ‘This survey shows the importance for businesses in remaining vigilant in the face of financial fraud. As a minimum step, we would encourage businesses and employees up and down the country to remain vigilant to help protect themselves from fraud.’