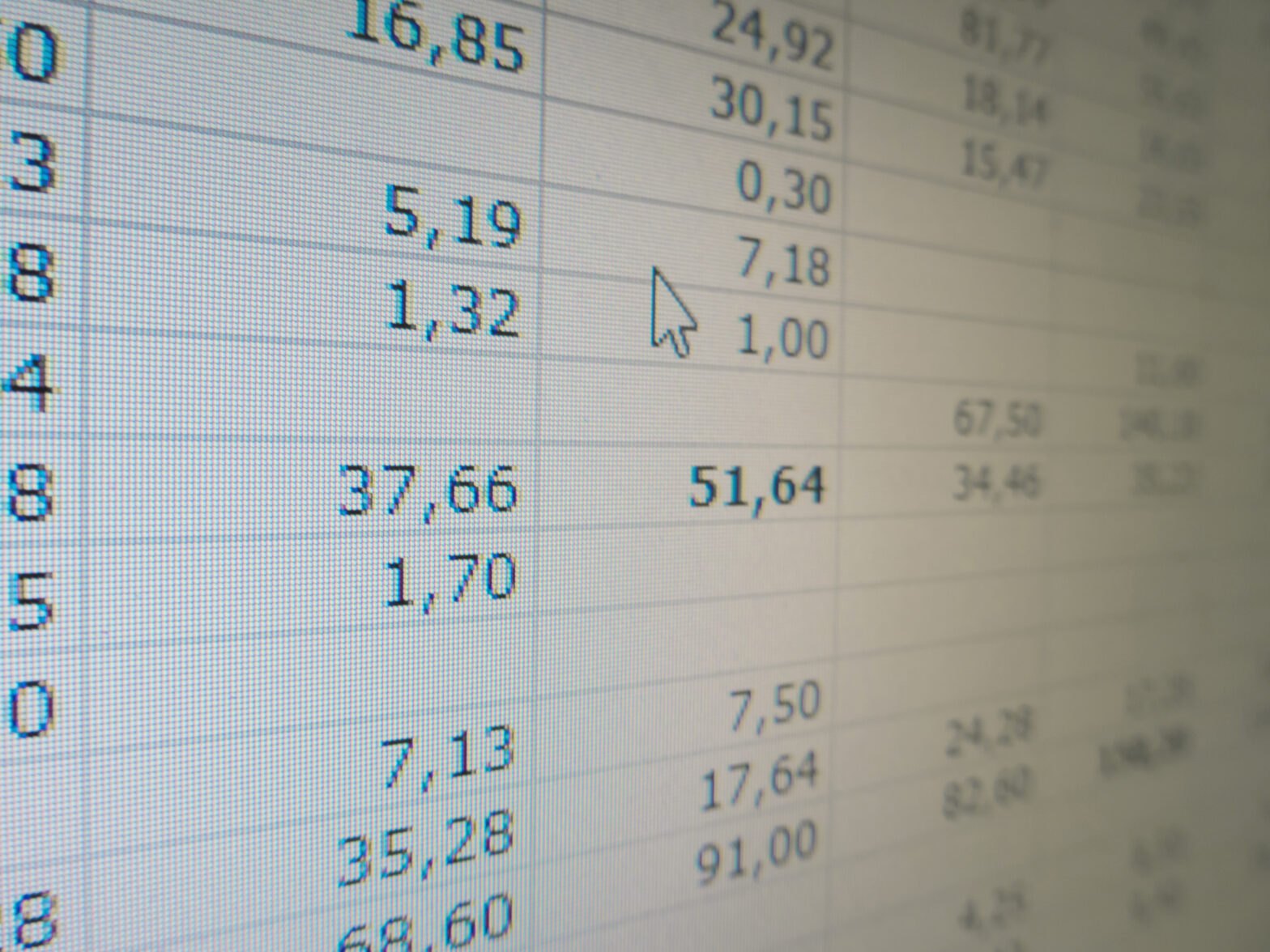

One of the biggest headaches experienced by a start-up or a growing business is that of managing financial information and business data. Finding it, capturing it, measuring it, managing it, analysing it; the list goes on. For many budding entrepreneurs and business owners, their first experience of managing this critical data is through use of spreadsheets.

Spreadsheets are easy to use and very familiar to users largely through the all-pervasive Microsoft Excel. However, ‘familiarity and convenience’ do not often translate into ‘efficiency and effectiveness’. I believe many SMEs are missing a trick, and, more importantly, putting their businesses at risk by persevering with this archaic, limiting practice, especially when you consider the tools now available to SMEs through cloud computing and the Software as a Service (SaaS) model.

Its greatest success is also a weakness

There are hundreds of reasons why spreadsheets are useful. You can make a searchable list, you can add some formulae to make a model, you can create visual elements that help with understanding and interpretation, and you can even create a macro to provide an element of programming. So at first you are delighted. You can self-teach some functions and continue running your business, manually inputting data, happy in the knowledge it is not costing you anything bar some initial software costs. However, somewhere down the line you will come unstuck, as you increasingly need to utilise the data and knowledge that resides within your company. It is a need that only increases as you seek to become more efficient and intelligent regarding business operations. In short, you need to analyse.

Unfortunately, the fundamentals of a spreadsheet’s success – ease-of-use and accessibility – are also two of its greatest weaknesses. What starts as a small project in a spreadsheet often grows into Frankenstein’s monster cells. Whether it’s a financial forecast model, a marketing plan or a sales analysis… as your company develops, so does the complexity. Multiple people work on it, not understanding what’s happened before which results in breaking or misunderstanding each other’s work. Everyone forgets about the rough initial assumptions or the ‘known bugs’. There’s no way to check, test or audit it, yet major strategic decisions are made on its results.

And hidden to the board, the accounts department are using spreadsheets to join together all the separate applications with financial data: the CRM Sales app, the ecommerce platform, the accounts package, the app that downloads sales data from a reseller… And none of these spreadsheets are reliable, despite the huge amount of staff time they soak up.

Excel has become the glue that holds the company’s finances together, and the programming tool that underpins management and the board’s decisions. All things a spreadsheet was not designed to do.

Where spreadsheets fail

There are many examples of the limitations of spreadsheets and for the purposes of this article I have listed the most common ones below:

• Errors are easy to make but hard to identify and address

It is incredibly easy to start making spreadsheets. However it is also incredibly easy to make mistakes that can cost a company thousands. The problems are not new and were well publicised as far back as 1994, gaining notoriety in 2008 when Professor Raymond Panko from the University of Hawaii analysed a sample of spreadsheets used in ‘real-world environments’ and concluded that 88 per cent had errors. Recent research confirms this is still a relevant figure.

• Calculations are slow and are not scalable

Spreadsheets are not scalable and cannot grow with the business needs

• Collaboration is difficult

Although Google Spreadsheets allow easy collaboration, and Excel can now allow some, they do not make it easy to control or see who’s done what – so you can easily rely on a model that is incorrect

• Hard to control

The more spreadsheets are literally ‘spread’ throughout the company, the harder it is to know who did what and to which version

• If created by others they’re not always easy to understand

It is rare that two people’s thought processes are the same and inheriting a spreadsheet can cause misinterpretation

• Resources drain

With no automated procedures, the time needed to create, update and maintain spreadsheets could be considered prohibitive

• Data analysis is difficult

The difficulty in linking data makes cross-document analysis impossible. The layout also causes issues, as to see a large document in full would require a huge screen

• Hard to define and enforce workflows

These days most businesses use workflow processes to automate business functions. Spreadsheets do not offer workflow capabilities

But modern businesses do not have to accept these failings.

Cloud levels the playing field

Historically, suitable tools including databases, the old Executive Information Systems (EIS), or Management Information Systems (MIS) were the ‘go to’ products to deliver more sophisticated business analysis, albeit with their own quirks and challenges. At the time, these products were out of reach of most SMEs due to their significant upfront cost and the IT platforms required to run them. These days, the advent of cloud computing has changed all that, levelling the playing field in the process.

Using cloud delivery techniques, even SMEs can have access to the ‘latest and greatest’ applications. The move from a CAPEX to OPEX mode of operating – common with cloud computing – means you can effectively ‘rent’ access to the latest applications and, depending on your terms and conditions, buy access to enterprise-level software according to need and budgets. The disappearance of such a significant upfront capital cost is great news to SMEs, who for the first time have access to enterprise-level software that integrates business operations. Additionally, many cloud providers offer a bespoke development service and have in-house specialists who can tweak applications to suit your company’s specific requirements should you not want an ‘off the shelf’ package.

We identified two problem areas with spreadsheets:

1. large, complex, unreliable models

2. used as unreliable glue between systems

We can attack #2 by integrating systems as much as possible, which in practice means using cloud apps because many of these have web APIs that let them talk to each other. One of these, NetSuite, offers much of the functionality that a business will need in a single app and can be integrated with other specialist apps as necessary. Salesforce is just CRM but offers a platform for other apps that makes integration easier.

Dealing with #1 is harder. NetSuite offers financial forecasting and budgeting, but it’s not nearly as flexible as a spreadsheet. Analysis apps are available, but often hard to use. The best route is to use apps as far as you can but then to control the use of spreadsheets as if they were controlled drugs in a hospital: keep them tightly locked down, document changes, regularly check and test them and monitor their usage and effects.

Related: Cloud and SaaS accounting — what are the advantages?

Some practical spreadsheet modelling tips

• Put all the assumptions and inputs in a separate area; all other cells must contain only formulae (no numbers).

• Keep adjacent columns identical so that you can copy and paste across them – so don’t mix monthly and annual columns.

• Include cross-checks on totals.

• Enter a huge number in each of your inputs and see if it ripples through as you expect.

Risky business made less risky

In my experience, when businesses rely on spreadsheets to run their business, they open themselves up to a world of future problems. The truth is that many small and medium sized businesses still depend on numerous disparate spreadsheets as they wrongly think they can manage their business processes and ‘make do’. Clearly they don’t have the resources of a large blue chip organisation to invest in more appropriate and sophisticated applications, train every user and absorb losses while it all comes online. However, all businesses are increasingly driven ‘by numbers and analysis’ making it critical to get this aspect right.

You will never prevent SME owners using spreadsheets as they start a business – it is too convenient and sometimes essential. But it is important to recognise a spreadsheet’s limitations, and being aware that there will be a time when such practice will limit success or potentially slow development. However, this needn’t be the case, as there are applications out there that can be sourced and utilised – and can fit all budgets. SMEs for their part should look to develop a close relationship with a knowledgeable IT partner, get access to the latest software and services and take advantage of the levelling playing field.

Ben Gladstone is director of Conosco.