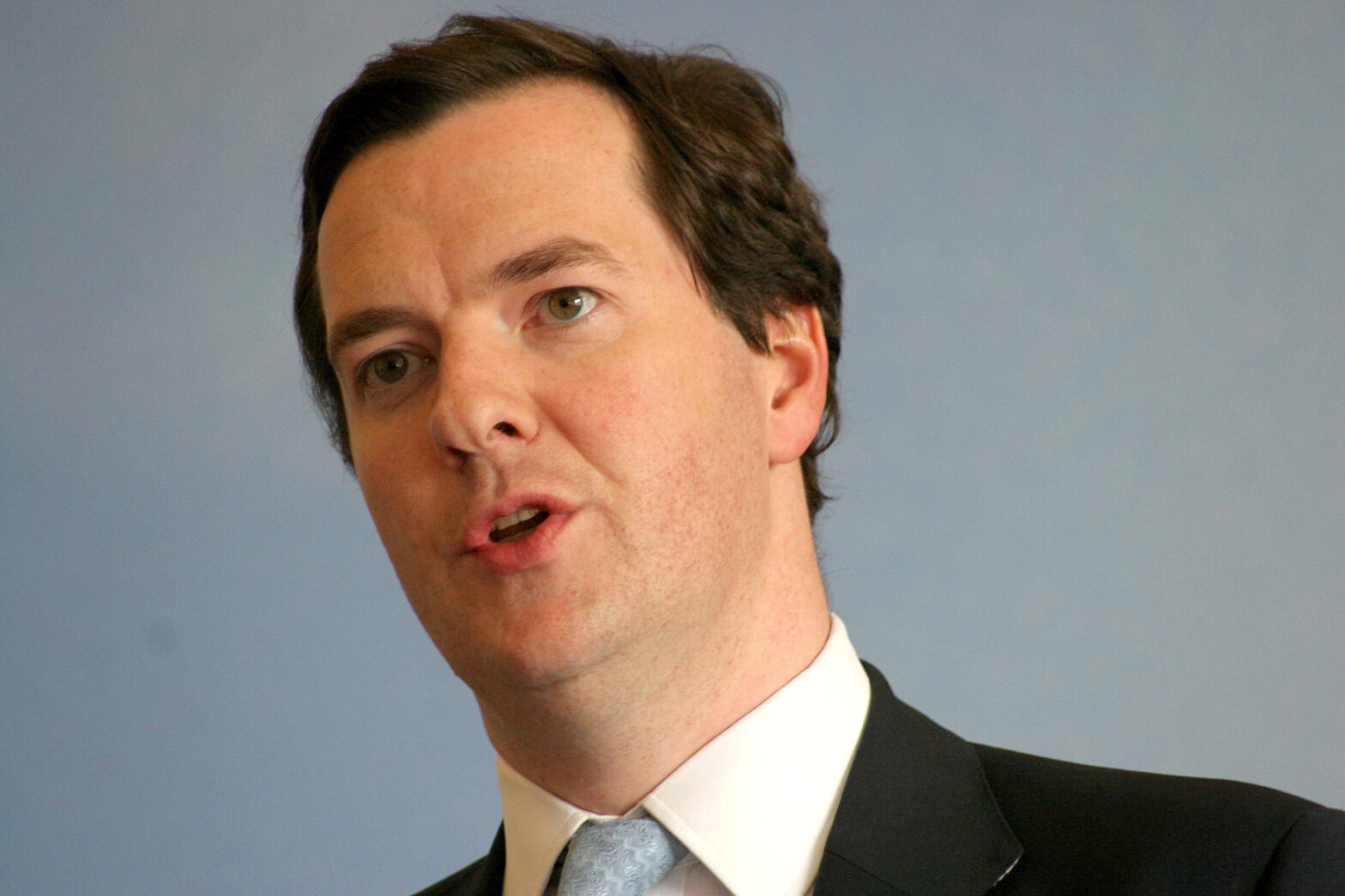

The Spending Review had ‘little to offer’ the micro-business community, say business commentators.

Jason Kitcat, micro-business ambassador for Crunch Accounting, says that extending the small business rate relief and enhancing free childcare will be welcomed by many micro-business owners.

However, he adds, ‘Overall this spending review had little to offer the 8.4 million people who work in the micro-businesses community. Smaller businesses barely got a mention and there was no rethink on the hike in dividend taxes which will hit smaller businesses hardest.’

Emma Jones, founder of small business support network Enterprise Nation agrees, saying that the Autumn statement showed that small business is less of a priority for government and that it expects the private sector to step up to take over its business support function.

‘A detailed examination of the Spending Review reveals UKTI, for example, is already making plans to refocus and reinvest in order to hit export targets by ‘developing the private sector market,’ Jones adds.

Alan Watson, head of rating at property and planning consultancy Rapleys, also takes a dim view of the Statement, saying that Chancellor’s reiteration of his plan to scrap the uniform business rate is ‘another step backwards for business’.

‘The Chancellor risks a return to the landscape seen in the 1970s where businesses may be paying completely different rates for properties on either side of a road, just because of jurisdictional discrepancies.

‘With devolved budgets and no UBR buffer, those local authorities who need to fund costly public services may need to raise rates, further threatening the viability of local businesses.’

Watson says that the good news on rates from the Chancellor is the decision to continue with the small business rate relief scheme that has been in place for several years.

However Ed Molyneux, CEO of accountancy software company FreeAgent, takes a brighter view of the Statement. ‘As an entrepreneur, I’m glad that reform of Entrepreneurs’ Relief, which some commentators had warned of, has been only minor. This relief recognises the very considerable personal risks that entrepreneurs take to build businesses, and I would have like to have seen reliefs extended to early employees’ share options as well,’ he says.

‘Those options represent an important mechanism at our company for fostering a sense of genuine ownership among employees.’