In response to the consultation entitled Audit Exemptions and Change of Accounting Framework, the coalition government has outlined measures to curb red tape for small and medium sized enterprises (SMEs).

According to a statement, some 100,000 UK businesses are set to benefit from the change which will see an alignment of mandatory audit thresholds with accounting thresholds meaning that an SME will be able to obtain an exception if it meets two out of three criteria relating to balance sheet total, turnover and number of employees.

The government says that this alteration will now allow 36,000 companies to opt out of having an audit.

Further changes also mean that most subsidiary companies will now be exempt from a mandatory audit, on the condition that the parent company guarantees liabilities. This development is said to remove a further 83,000 firms from the process.

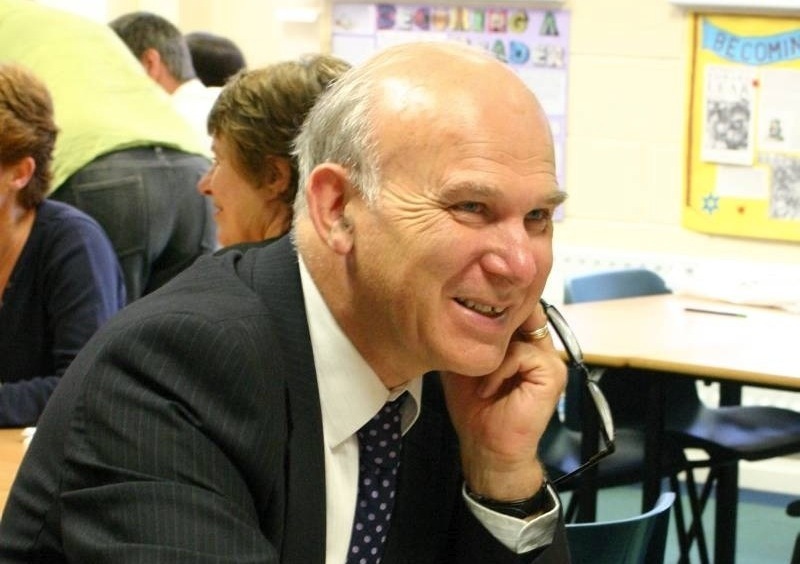

Business secretary Vince Cable says that reporting requirements have become increasingly demanding and costly over the years.

He adds, ‘We listened to business, who made a strong case for reform, and I am delighted that we are now taking this opportunity to make audit more flexible and targeted.

‘Tackling these problems will help save UK companies £millions every year and free them up to expand and grow their business, which ultimately benefits the entire British economy.’

The government hopes the new regulations will remove EU gold-plating and ensure UK SMEs are not at a disadvantage compared to European competitors.