The Co-Operative Bank has nearly doubled its free-banking offer for start-ups and SMEs from 18 months to 30 months.

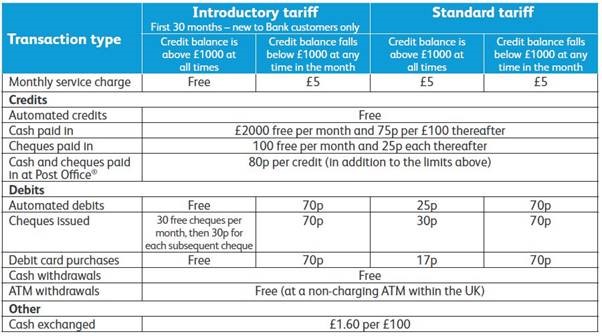

New small business customers will benefit from free everyday banking – subject to certain transaction limits and a minimum credit balance of £1,000 – making it, says the Co-Op, the best introductory offer in the market.

The Co-Op bank aims to double its market share over the next five years, with a particular focus on supporting ethically minded businesses. One in five SMEs (22pc) are set up with a broader social purpose in mind.

In 2018, the Co-operative Bank had over 84,000 SME accounts, including 750 co-operatives, 5,000 charities and 218 credit unions, making it the seventh-biggest provider for business current accounts.

SME customers will then go on to the standard Business Directplus tariff once the 30-month period expires.

Official data indicates that businesses are most likely to struggle in their second year, says the Co-Op. According to the Office for National Statistics (ONS), one in four (26pc) of the approximately 380,000 businesses established each year are likely to struggle or fail within their first two years.

Existing Business DirectPlus customers currently in their introductory period will see it extended by 12 months, in line with the new offer.

Donald Kerrr, newly appointed managing director of SME banking at The Co-operative Bank, said: “Our market-leading introductory offer is another step in improving competition for UK SMEs and supporting them to be better and stronger businesses. Data shows that the second year of an SME’s life is its most difficult; extending free banking by a year will be an important helping-hand which eases pressure for entrepreneurs at a crunch point in their development and provides them with additional support.

“Our aim is to pioneer banking that makes a positive difference to small businesses and, as the only UK high street bank with a customer-led Ethical Policy, we’re ambitious to support SMEs so they can develop not only their bottom lines but also build a new business that is clear on its values.”