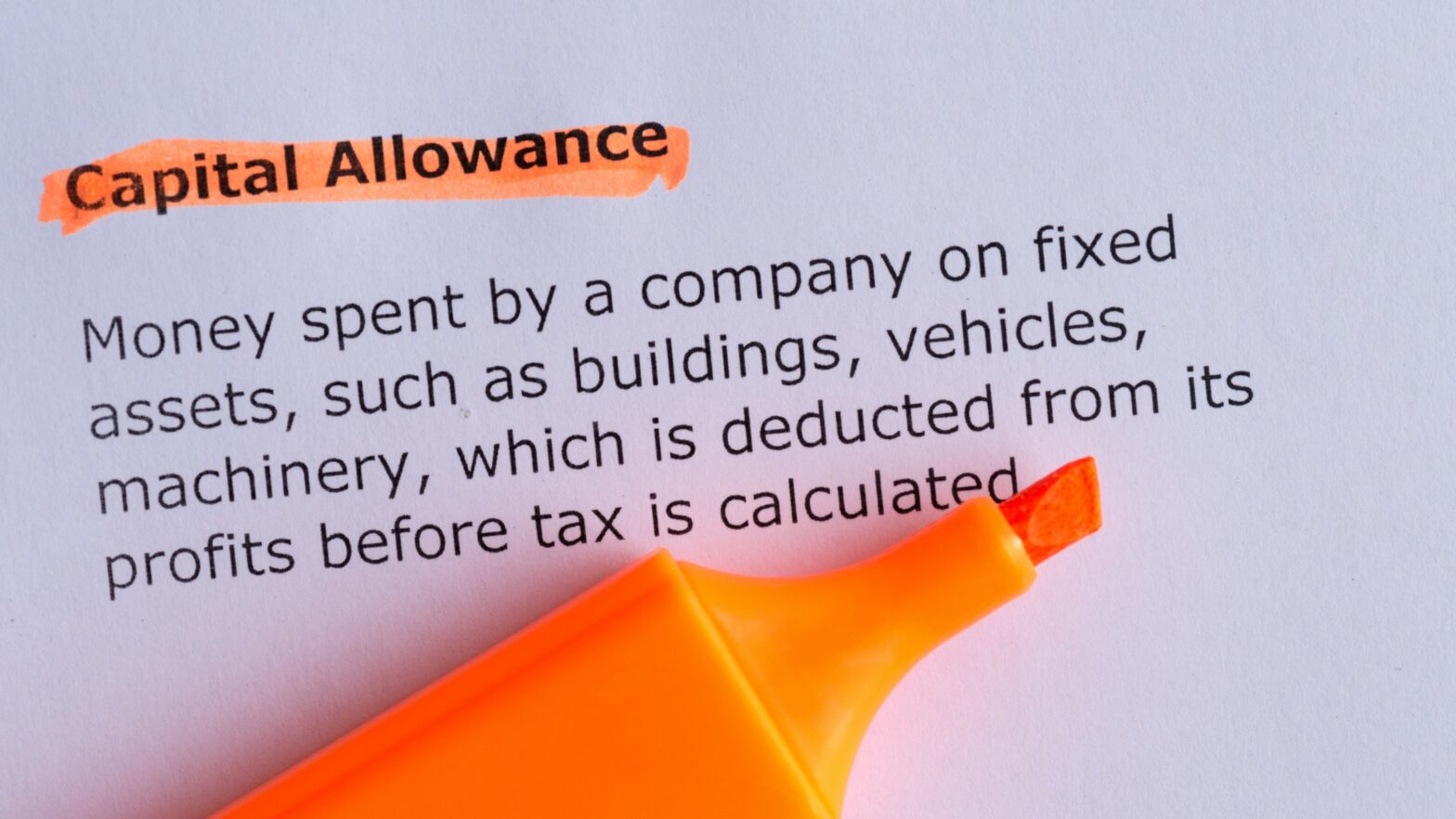

Do I have to register for PAYE if I do not have employees?

If you’re the director of a business that does not employ anybody do you need to register for PAYE? The answer is not always straightforward, says Jacqui Reeves, senior payroll manager at accountants Hillier Hopkins

Accounting