The Government will not after all announce reform of business rates for small businesses in the Budget, as had been expected.

Business rates reform has been “thrown into the long grass” according to the Daily Telegraph and instead only small-scale tweaks will be announced after the Budget on October 27.

This would be the fifth time the Government delayed publishing its plans for business rates reform.

In March 2020, the Government announced a new consultation and said that the first part of the business rates review would be published in the tail end of 2020, with the second part in early 2021.

There have already been four delays to publishing the business rates review this year.

Independent retailers trying to make a go of things on the High Street complain they are penalised by unfair business rates, while out of town retailers in bigger retail parks pay less per square foot.

Plus the internet retailers rely on even cheaper distribution warehouses in the hinterlands, reducing their costs even further.

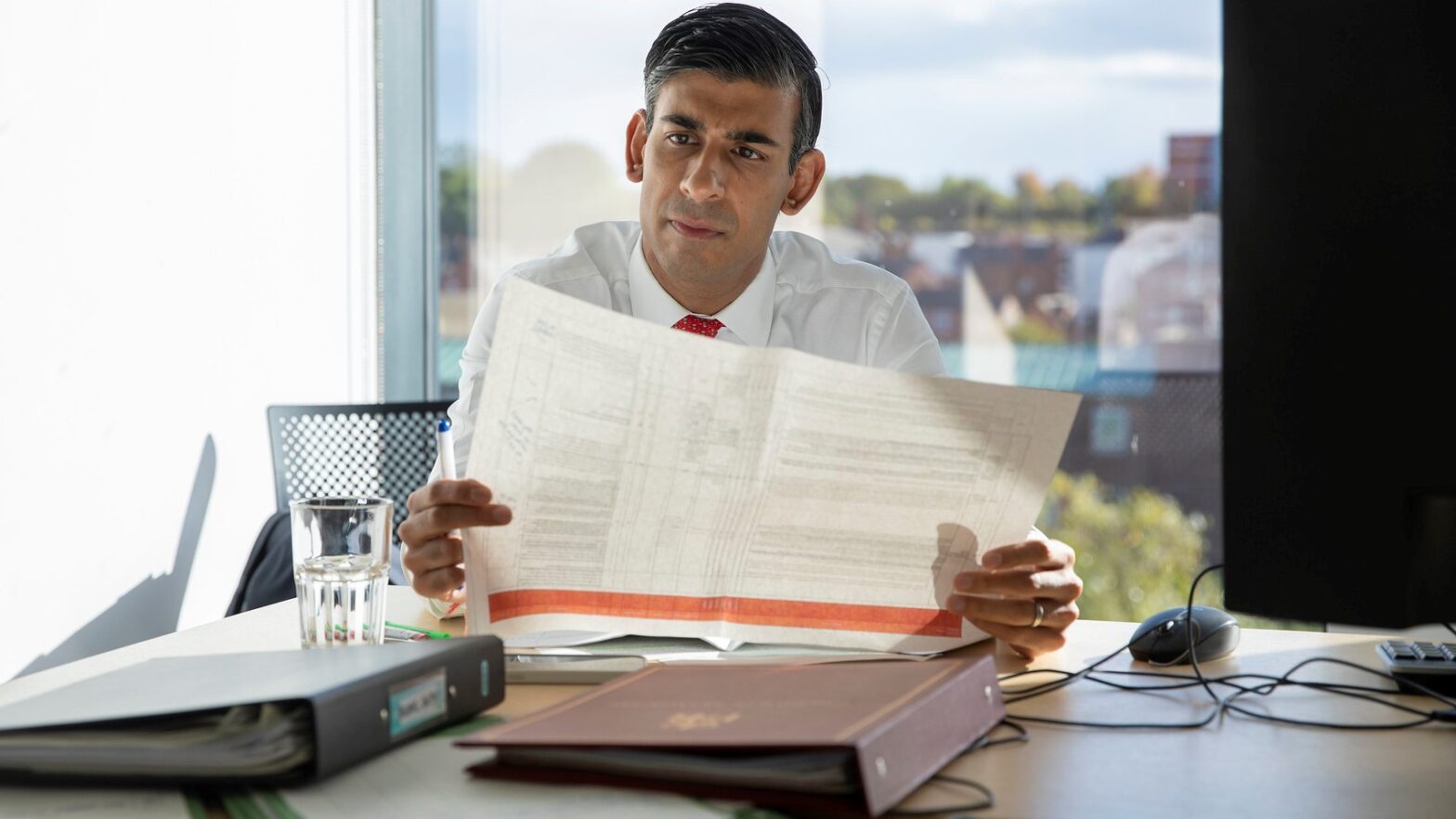

However, chancellor Rishi Sunak has not had enough time to consider the impact of a complete overhaul of business rates, according to the newspaper. Minor changes to business rates are expected to be announced, but “wholesale reform” has been shelved until a later date so ministers and officials can keep studying the problem.

One Government source told the Telegraph: “I think the expectations are quite high and the reality is we just haven’t had enough time to look at it. It’s obviously something that needs looking at. Rishi is keen to do a proper reform of the whole system.”

The Chancellor believes that reform is particularly needed to tackle “the problem of high street versus online” retailers, the source stressed.

In its party conference, Labour pledged to cut business rates in England for small business before phasing them out entirely.

John Webber, head of business rates at Colliers, called reports of yet another delay “massively disappointing” and warned that more delay will be a further hit to businesses, costing jobs and doing nothing to save the high street.

Webber reiterated that in current form business rates are just too high and that the multiplier at current levels of 51p in the pound is unsustainable for business.

“The chancellor, at the very least, should commit to a reduction of the multiplier to around 30p when he stands up at the end of the month,” said Webber. “That would provide a massive relief to businesses across all sectors.”

Further reading on business rates reform

Business rates review 2021 – what your small business can expect