Brexit was officially set in motion last month and the UK’s withdrawal from the European Union is already underway. From January 31, 2020 until the end of December 2020, the UK and EU will be in a transitional period of alignment with the EU during which both parties will hopefully negotiate new trading agreements. Interestingly, the implementation of the UK’s withdrawal from the EU is already throwing up some concerns about how UK businesses are likely to fare at the end of the transitional period.

Brexit will affect everybody living in the UK and in the EU to varying degrees and businesses on both sides of the divide must be ready to adapt to new realities as free trade of products and services and the free movement of people happen under a new set of rules.

A state of uncertainty

For the rest of 2020, businesses are likely to be stuck in limbo even though they are theoretically supposed to be operating under existing trade agreements. The fact that businesses don’t know how the business landscape, their relationship with EU counterparties, tariffs, paperwork, or shipping routes might look like in the next 10 months is precipitating dark clouds of uncertainty. The uncertainty is particularly worrisome for small businesses that lack the resources to create comprehensive contingency plans.

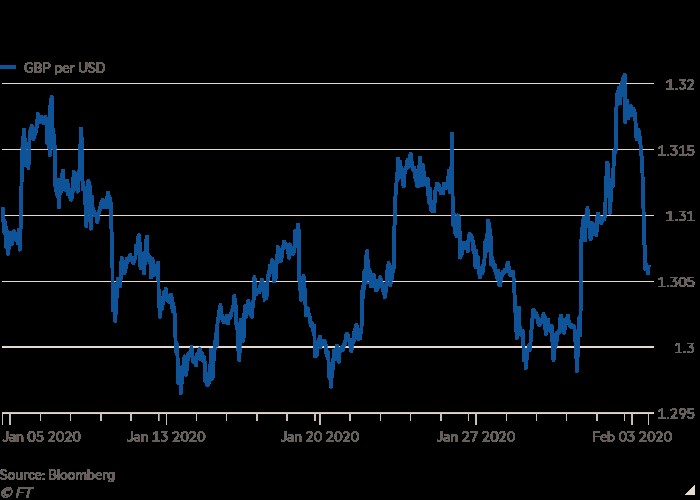

Starting with currency headwinds, the value of the pound declined in the first trading day (February 3) after the UK officially implemented Brexit in response to insinuations that the UK was willing to walk away without a deal with the EU. The GBP declined by 1.4 per cent against the dollar to $1.3011 in the global forex market to set the stage for the biggest daily decline since December 2019.

Unfortunately, the forex volatility in the GBP relative to other currencies is likely to continue for much of this year as the currency moves in relation to whether the negotiations are tending towards a deal or no deal.

As the currency uncertainty continues to linger, it might be smart to have a mix of conservative and a small percentage of speculative stores of values such as fiat, gold, and digital assets. Cryptocurrencies such as Bitcoin are historically highly volatile, and the volatility provides a high-risk high-reward opportunity.

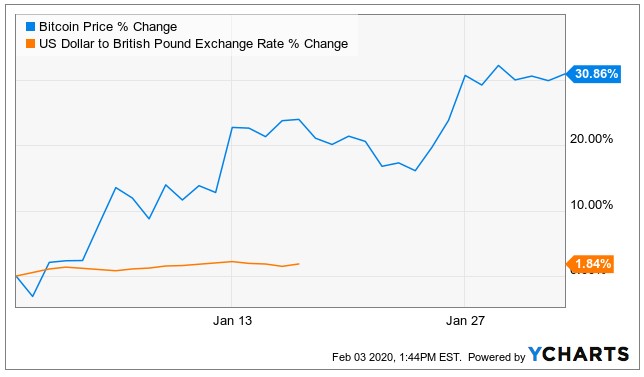

Interestingly, 2020 is shaping to be a year packed with many potentially volatile events such as Brexit negotiations, US elections, and the coronavirus just to name a few. Many people are already exploring how to buy Bitcoin to hedge in the volatility in traditional assets. For what it is worth, Bitcoin has gained 30 per cent and the dollar has strengthened almost 2 per cent against sterling in the same period (see chart below)

What a no-deal Brexit might mean for small businesses

The Boris Johnson led government has reiterated its commitment to secure a trade agreement with the EU before the end of the transition period. However, if it is unable to secure the deal and the transition period is not extended, the UK will no longer be a part of the EU and it would have to conduct trade with the EU under extant World Trade Organization rules.

The most significant part of a no-deal setup will be that UK businesses seeking to conduct trade in the EU and EU businesses seeking to do business in the UK will be subject to new tariffs and customs checks. UK’s current relationship with the EU facilitates tariff-free trading between both economies but a subsequent no-deal might see the EU imposing tariffs on UK goods and vice versa.

Tariffs are usually a two-way street – on the one hand, the tariffs on EU goods might make them less competitive in the UK and cause UK businesses to flourish at home while seeking other markets outside the EU. On the other hand, the tariffs might rob UK goods of sales in the EU. If the goods can’t be sold in the EU and other markets haven’t opened, the goods might have a supply glut leading to falling prices which could potentially hurt UK businesses.

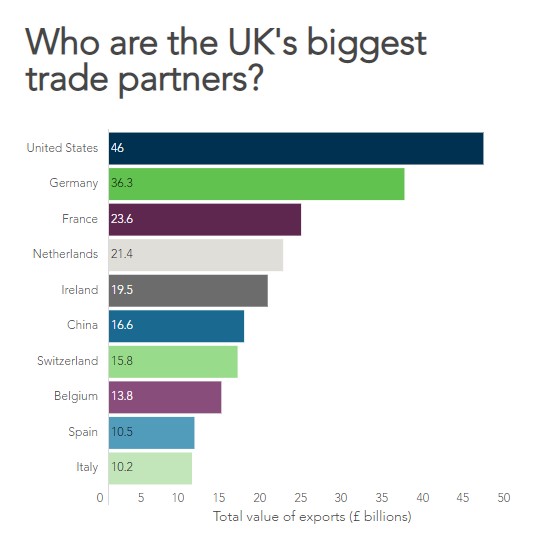

Another potential outcome of a no-deal Brexit that will affect both businesses and consumers is custom checks both for UK goods going into the EU and EU goods coming into the UK. Six of the UK’s top 10 trading partners are in the EU and UK goods going into the EU will be required to pay import tax and duty on goods in addition to showing proof that the goods follow EU health and quality standards.

If the UK exerts a similar tariff on EU products, EU products coming into the country will potentially become more expensive as companies try to offload the additional expenses to consumers. And yes, it will take longer for EU goods to clear customs before they make their way to UK shelves.

Conclusion

If the UK government succeeds in negotiating a deal with the EU, there probably won’t be much difference between the current trading relationship in which the UK is part of the EU and the post-Brexit world. A comprehensive trade agreement will cover everything from the migration of persons to import duties, taxes, and customs.

However, the Boris Johnson government has been open about the possibility that Brexit will be implemented without a deal with the EU. Hence, UK businesses need to start proactively war-gaming how to stay competitive in the post Brexit era with or without a deal with the EU.

According to the UK government, “delivering a deal negotiated with the EU remains the government’s top priority. With an implementation period until December 2020, this would give businesses stability, certainty and time to prepare for our new relationship after EU Exit”.