Bill Esterson, the shadow small business minister, spoke out of turn this week when he pledged Labour would stop the rollout of IR35 tax changes to business.

Speaking on Monday night, Esterson pledged at a small business hustings in the City of London that Labour would scrap IR35 being extended to the private sector, despite there being nothing about it in Labour’s manifesto.

“We absolutely can’t see it rolled out into the private sector the way things are at the moment,” Esterson told the hustings.

“It should never have been implemented in one go.”

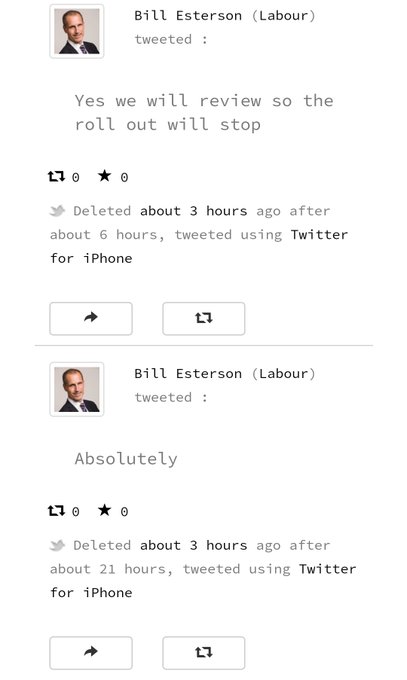

Asked later to confirm if it was Labour Party policy to review IR35 and not rollout changes out to the private sector in April 2020, he tweeted: “absolutely”.

>See also: Labour small business minister: ‘Boris just says whatever pops into his head’

However, that tweet was subsequently deleted:

Esterson told Small Business that Labour policy was now to review IR35 changes before they come into effect.

IR35 will draw sole traders and freelance contractors into the tractor beam of IR35, which HMRC sees at tax avoidance when freelance contractors are effectively permanent.

Liberal Democrat deputy leader Sir Ed Davey was the big winner at the City hustings, organised by the Association of Independent Professionals and the Self-Employed (IPSE) and small business network Enterprise Nation.

Fifty-four per cent of the audience of more than 100 small business owners, investors and freelancers backed the Liberal Democrat vision for small business once the event was over, compared to 36pc for Conservatives and 21pc for Labour.

The Conservatives and Labour had the biggest falls in support in the “exit poll” – down 12pc and 10pc respectively – compared to their support going in.

Esterson bounced off questions on Labour’s plan to increase corporation tax to 21pc for businesses with turnover of less than £300,000, bringing dividend taxation in line with income tax and scrapping capital gains tax relief for entrepreneurs selling their businesses.

He did however support Ed Davey’s call to replace business rates with a levy on land value, as did the Green Party’s Amelia Womack and Hector Birchwood of the Brexit Party.

Womack, deputy leader of the Green Party, claimed that former Tory supporters were “joining the Greens because of our policies on small businesses”, including scrapping business rates and reducing VAT for hospitality businesses.

Conservative trade secretary Liz Truss provoked laughter in the room when she said that Boris Johnson’s revised deal with EU was “very good”.

Further reading on general election

General Election 2019: what the parties say about small business