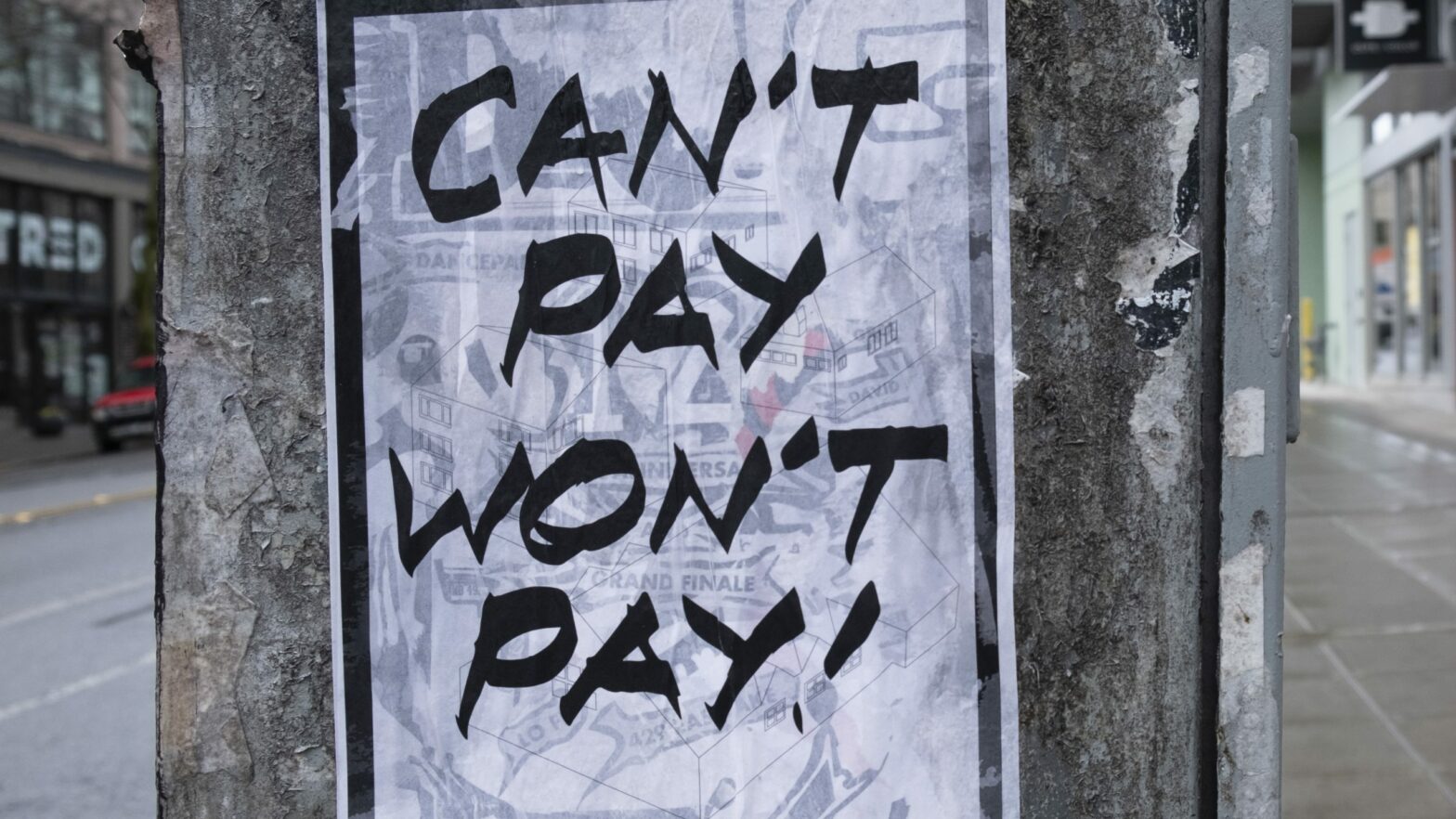

Nearly half of small businesses that have taken out government emergency coronavirus loans do not intend to repay them.

Forty-three per cent of businesses that have taken out either Bounce Back Loans or Coronavirus Business Interruption Loans say they do not believe the government will chase the debt, or that they will be unable to repay the loan, according to the Business Banking Resolution Service.

Nearly 60 per cent of the 500 small businesses surveyed by the BBRS have accessed government-guaranteed loan schemes.

The Bounce Back Loans offer struggling small businesses up to £50,000 interest free for the first 12 months, with a low 2.5 per cent interest rate after that.

The Coronavirus Business Interruption Loan Scheme (CBILS) supports loans of up to £5m per small business.

>See also: Microbusiness £50,000 Bounce Back Loans – how they work

According to UKFinance, both schemes have lent £22bn of government-backed loans between them to almost half a million businesses.

Over £14bn has been handed out through Bounce Back loans, along with more than £7bn via the Coronavirus Business Interruption Loan Scheme which is aimed at slightly larger players and has stricter rules.

The BBRS survey raises the prospect of thousands of firms having to be pursued through the courts for what they owe – with many more going bust despite the Treasury’s generosity.

A total of 27 per cent of respondents to the BBRS survey said they do not believe they will be chased for the debt, and 16 per cent warned they will not be financially strong enough to repay it in any case.

Lewis Shand Smith, chairman of the BBRS, said: “Government-backed loan schemes have provided a lifeline. But it is critical for customers to understand that, just like any other loan, they will be required to repay 100 per cent of the money they borrow under these new schemes. There needs to be clarity about that now to avoid the risk of storing up problems for the future.”

Stephen Jones, chief executive of bank lobby group UK Finance, told the Telegraph fears many firms are already treating the state-backed loans as grants which will never need to be repaid.

Convert bad loans into equity

However, 37 per cent of small business decision makers surveyed said they would consider swapping the debt for the government taking equity in their business.

>See also: State could take equity in small businesses, suggests Lloyds chairman

Obviously the idea of the Treasury becoming a shareholder in thousands of microbusinesses is unworkable.

Some experts have said the Treasury needs to be realistic about what to do about small business loans that do go bad in a year’s time.

Mike Cherry, national chairman of the Federation of Small Businesses, has suggested that the 100-per-cent government-backed loans should be treated as student loans, repayable over a much longer period when borrowers cannot afford to repay – or waived entirely under exceptional circumstance.

Roger Barker, head of corporate governance at the Institute of Directors, told the Telegraph that government loans could be turned into a new kind of debt, to be repaid according to financial performance. This would prevent struggling small businesses from going under once the interest-free period expires and repayments start to bite.