The government’s tax credits for research and development expenses has been a catalyst for innovation and experimentation across the economy. By subsidising long-term investments in better processes, new technologies, and modified techniques, the government has offered businesses of all sizes an opportunity to carve out a sustainable competitive advantage.

However, most businesses are still either unaware of the program or underestimate its benefits. If you plan to apply for R&D Tax Credits, here are some interesting facts you need to know and some common mistakes you need to avoid:

Facts

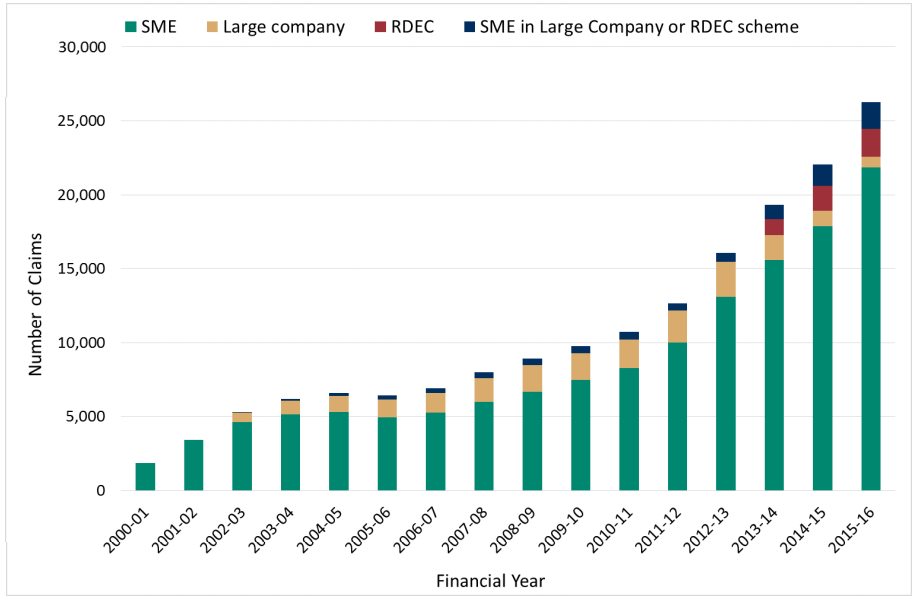

The UK R&D Tax credit program has been a massive success. The number of claims for R&D tax credits has expanded every year since the launch.

- The vast majority of recent claims have been made by small and medium-sized businesses. In 2015-16, 83 per cent of the claims were from SMEs across Britain.

- In the most recent recorded year, the amount of funds disbursed to support R&D across the country through this program more than doubled to £1.3 billion for SME businesses alone.

- SME businesses can expect to claim over 26 per cent of their expenditure in tax relief. Even loss-making companies can roll over the relief for later and claim against future profits.

- Large companies filing through RDEC claimed nearly as much in 2015-16, with total claims valued at over £1.5 billion.

- Most of the businesses filing these claims are based in London and operate in the Manufacturing’, ‘Professional, Scientific and Technical’, and ‘Information and

Communication’ sectors. - Since the program’s launch in 2000-01, over 170,000 claims have been filed and more than £6.5 billion has been claimed as tax relief.

These remarkable statistics prove the value of this scheme. Businesses of all sizes from different industries have been able to benefit from this program. However, firms often make mistakes that reduces the tax relief or slows the process down. Here are some of the most common errors you should avoid:

Mistakes

Not claiming at all

Businesses that do not claim tax relief are missing out on an opportunity to reduce their taxable income and boost their investment resources. Smaller local firms are missing out on thousands of pounds in savings under the government’s tax relief scheme due to lack of awareness and common misconceptions about the program.

Not claiming enough

The value of the tax relief hinges on the way you qualify expenses for research and development. It’s easy to overlook some essential expenses that are part of the R&D effort and could qualify for tax credits. Make sure you have a professional on board to help you estimate your total R&D expenses and file for an adequate claim.

Not claiming for a loss

Even loss-making companies can claim tax relief. According to the HMRC, loss-making companies can file claims worth up to 14.5 per cent of the surrenderable loss.

Not keeping records

As with any other tax-related issue, maintaining meticulous and comprehensive records for HMRC is absolutely essential.

Many of these simple mistakes are avoidable. Most small and medium-sized businesses rely on expert consultants or online platforms like Tax Cloud to file their claims. This reduces the chances of error and the time it takes to get a claim approved by HMRC.