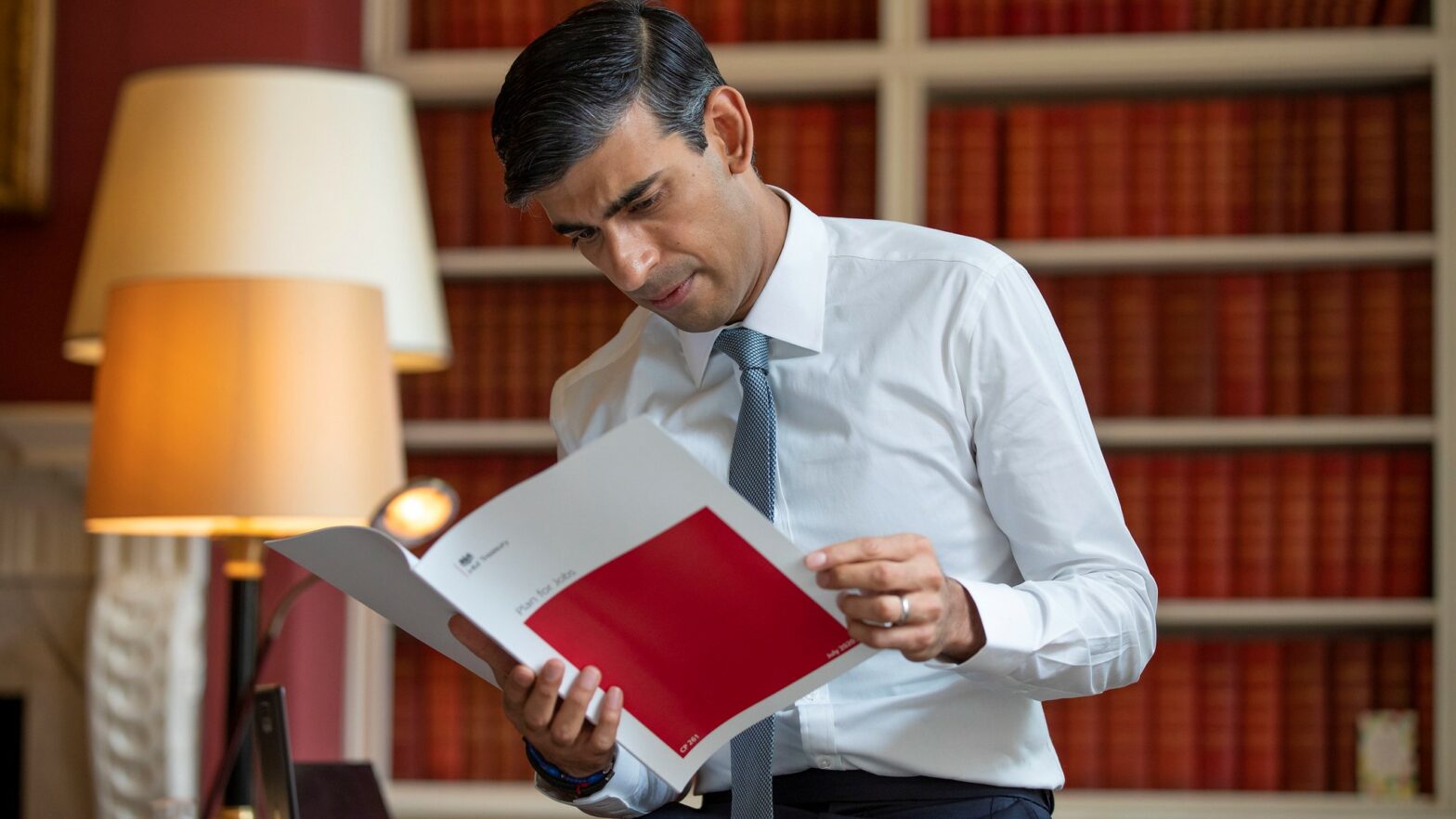

Rishi Sunak is eyeing raising corporation tax from 19 per cent to 24 per cent to help pay down Britain’s COVID-19 debt.

Such a move would raise £12bn next year, rising to £17bn in 2023-24, according to The Sunday Times.

Sunak will argue that 24 per cent is the global average tax rate for business and would still be lower than other European economies such as France, Germany, Italy and Spain.

>See also: Bank of England eyes Working Capital Jobs Retention Scheme

The corporation tax hike would be part of a £30bn tax squeeze on businesses, pensions and foreign aid, to help pay off the estimated £391bn the government will spend trying to stave off the economic consequences of Covid in 2020-21 alone.

Increase dividend tax

Meanwhile, the Treasury is also looking at increasing the tax rate for company directors who pay themselves in dividends – currently 7.5 per cent compared to a basic income tax rate of 20 per cent. Such a move would especially hurt sole traders and others who have already missed out on government COVID-19 financial support.

The Tories catcalled a proposal by Jeremy Corbyn’s Labour at the last election to tax dividends in line with personal income tax rates. Labour also proposed raising corporation tax to 26 per cent.

Bitter pill

Business leaders have predictably reacted with horror at plans to hike business tax.

Roger Barker of the Institute of Directors told The Times, ““Many companies are saddled with debt and are facing the prospect of significant restructuring in light of the new normal. Adding to the cost burden could hurt investment and jobs over the coming months … Lifting taxes on entrepreneurs would be a bitter pill to swallow after so many went without support during the lockdown.”

Mike Cherry, national chairman of the Federation of Small Businesses, said that hiking taxes would send completely the wrong message to those who have lost their jobs due to COVID-19 and were thinking about setting up on their own.

Cherry said: “Given we’re in a recession, the last thing policymakers should be doing is hiking taxes on those we need to invest, create jobs and generate growth over the crucial months ahead.”

>See also: Shops, gyms and restaurants call for £2bn property bounceback grant

And Adam Marshall, director general of the British Chambers of Commerce, said that by “piling taxes on to businesses” the government would “hamstring the recovery”. It risked “choking off growth at the crucial moment”, he added.

Advertising mogul Sir Martin Sorrell told the Telegraph that a comparison of corporation tax with other countries was blinkered, as Britain has yet to deal with the economic effect of Brexit on top of the coronavirus pandemic.

“What business needs is a further stimulus not a further depressant or downer,” he said.

Online sales tax

Meanwhile, the Treasury is intent on pressing ahead with a 2 per cent online sales tax to help level the playing field between Amazon and high-street shops which have to pay business rates.

However, some business groups oppose such a move, as every independent retailer has had to move its offer online in response to the pandemic. According to the ONS, online already accounts for one third of all retail sales in Britain.

Further reading

City grandees call for small business Covid debt to be turned into tax owing