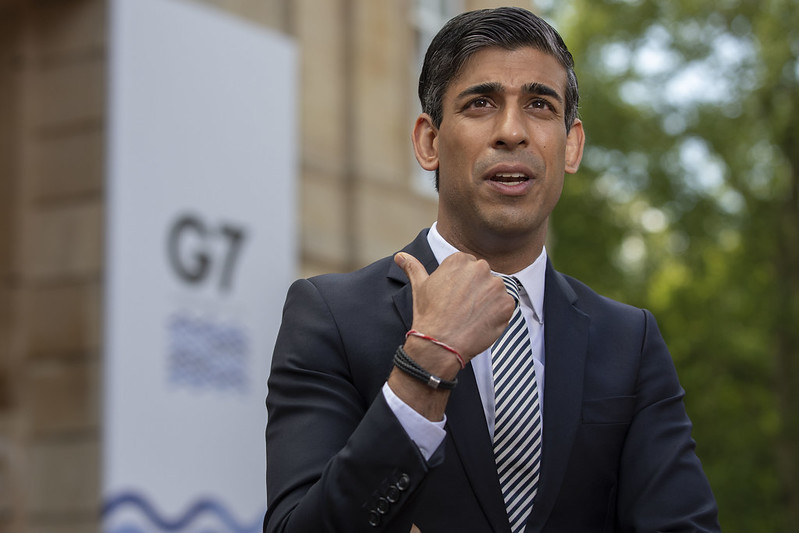

Chancellor Rishi Sunak has ignored small business pleas for more taxpayer support to help get them through extended lockdown until July 19.

Small business owners, and especially nightclub operators, face going out of business because of the government pushing back the lifting of lockdown restrictions until end-July. The fear is that government scientists will again point to Covid-19 infection numbers again going in the wrong direction, and Britain remains at the current level of restrictions until spring 2022.

The Treasury has pointed to local authorities still having £1bn at their disposal to help small businesses cover such things as business rates on a case-by-case basis. Other than that, its arms are folded.

- From the start of next month, small businesses will have to start contributing to the salaries of furloughed workers. Currently, the government covers 80 per cent of wages of workers in the furlough scheme. Next month that becomes 70 per cent, with employers having to cover an extra 10 per cent

- Hospitality, leisure and retail operators will also have to start paying one third of their business rates bill from the start of July, ending more than a year of the bills being waived.

- Small businesses also being protected from eviction by commercial landlords for non-payment of rent also looks set to expire next month as planned.

Mike Cherry, chairman of the Federation of Small Businesses (FSB), said: “Many small firms who have been hanging onto the edge will be left wondering if they can survive further periods of restrictions without additional support.

“Nightclubs have remained closed throughout the entirety of the pandemic. They have gone 15 months without income, all the while doing their best to support their staff, and they have now had their hopes of reopening on 21 June dashed. These sectors, and their supply chains, need ambitious and targeted support.”

Alan Thomas, UK CEO of SME insurer Simply Business, added: “The confirmation of a minimum four-week delay in lifting restrictions is a setback for the entire country – but particularly for the self-employed and those who own small businesses.”

Thomas said that Simply Business has calculated that Covid-19 will cost each small business £22,461 on average.

Further reading

Small business calls for support extension to match reopening delay