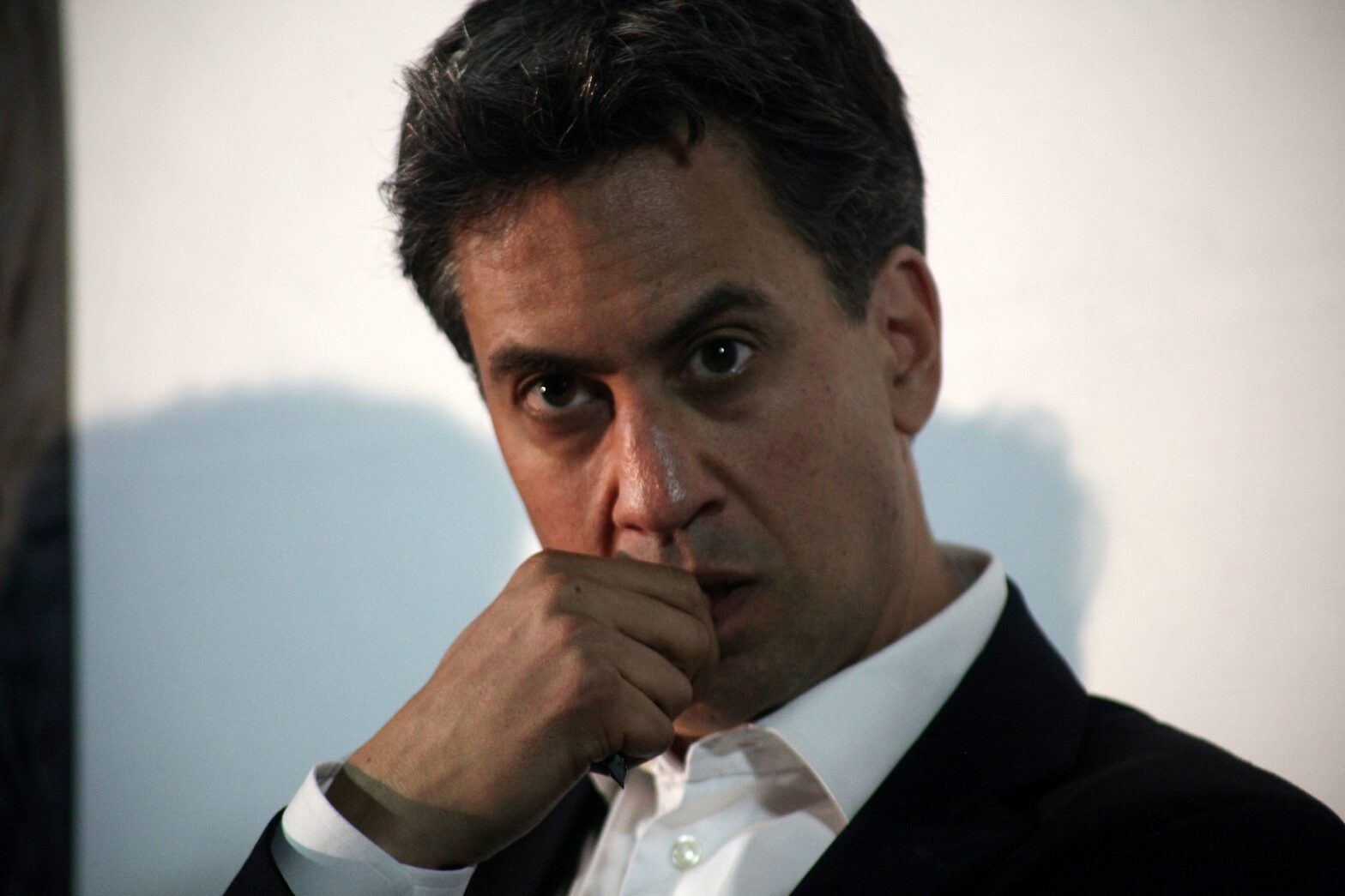

Economic support for those small business sectors hit hardest by coronavirus needs to be extended once Britain emerges from lockdown, says Ed Milliband.

The shadow business secretary said that travel, tourism and hospitality will need extended help from Treasury even as the rest of the country opens up again.

Milliband, speaking in a Zoom conference call hosted by accountancy software firm Intuit, said: “Economic support must match the lockdown exit strategy. The support needs to go on for longer if lockdown goes on for longer. If you lift lockdown too early, the implications for the economy and for the country would be disastrous.”

See also: Small business minister trying to help owner-directors hit by coronavirus

Shadow chancellor Annelise Dodds, speaking on the same call, echoed Milliband, saying that those small businesses in the travel, tourism and hospitality sectors could face disruption “for years”, and that there needs to be an ongoing system in place to support them.

Ed Milliband also voiced support for the furlough scheme to be softened so that small business employees could do some work even while furloughed, while the country drifts back to work.

‘Small businesses are in the frontline of this crisis’

Many small businesses worry that there won’t be many customers even if they are given the all-clear to reopen, with reduced footfall and demand.

Milliband said: “This is going to be a crunch fortnight and more needs to be done.”

100% guaranteed loans for microbusiness

Taking part in the same call, Martin McTague, head of policy at the Federation of Small Businesses, said that the government’s mooted 100 per cent guarantee for loans for microbusiness should ideally be separated from the rest of the Coronavirus Business Interruption Loan Scheme.

If that’s not possible, said McTague, then there should be an element of forgiveness with microbusiness loans, as with student debt, in that it’s written off if it cannot be repaid.

McTague pointed out how ineffective the CBILS has been compared to Switzerland. The Swiss government has rubber stamped 98,000 business loans compared to just 16,000 in the UK.

And another 15,000 CBILS applications are currently held up in a queue waiting for bank approval, said McTeague.

According to the Association of Practising Accountants, 60 per cent of small businesses will run out of cash within 12 weeks.

Dodds said: “It’s never been clearer how significant small businesses are to the UK economy. Small businesses are in the frontline of this crisis.”

Dodds said that she would be raising small business concerns with chancellor Rishi Sunak when they meet later today.

Further reading

Find your small business coronavirus grant – list of English councils