News

Tag

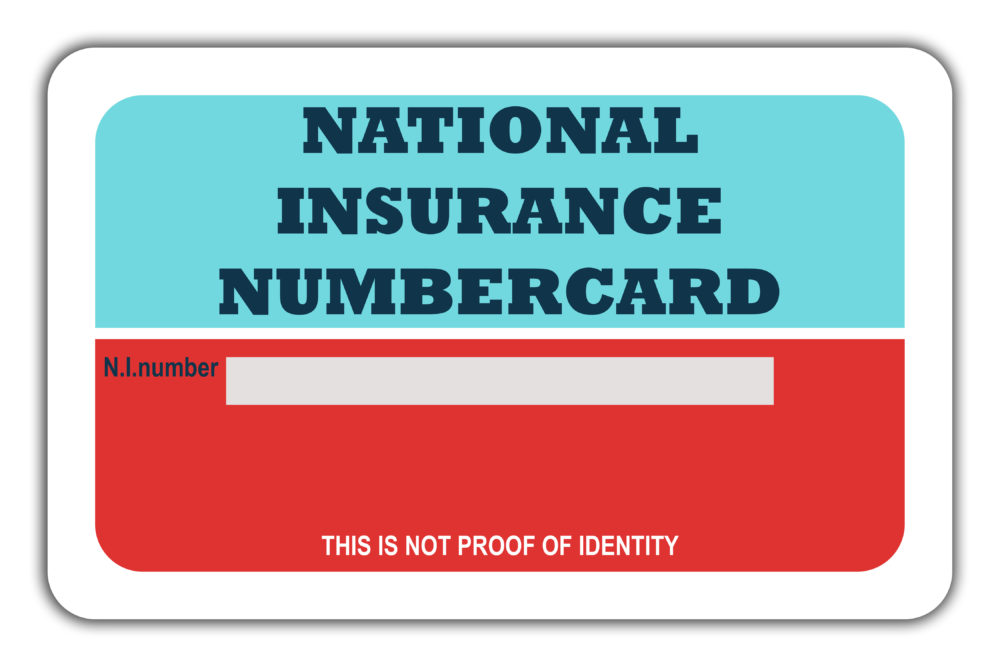

National Insurance

The National Insurance small business archive.

Small Business Insurance

The benefits of national insurance

Tax

Tax dilemmas

Recommended Content

Business Loans

A guide to getting a small business loan

Employing & managing staff

The importance of vocational rehabilitation services for SMEs

Partner content

What are the benefits of business broadband?

Partner content