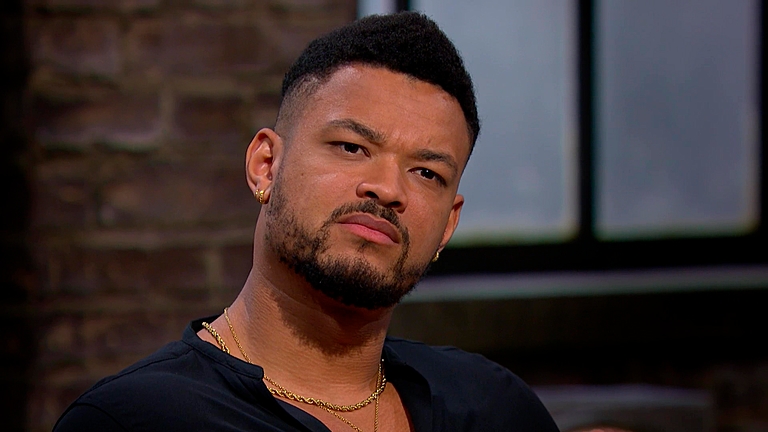

Steven Bartlett, entrepreneur and the latest addition to BBC’s Dragons’ Den, spoke to fellow entrepreneur James Sinclair for Osome‘s Revenue Masterclass.

The online discussion covered Steven’s feelings around getting to where he is now, struggles with payroll and why personal branding is the way forward for entrepreneurs.

#1 – Don’t buy into society’s expectations on sacrifice

Despite his relative success at the age of 29, Steven acknowledges that there are people in his life who are way ahead of him in terms of business success. He uses the example of Nick who, when Steven was 19 (Nick who was a couple of years older) sold a business at £40m.

Steven started his business as a university dropout at the age of 18. “At 18 the expectation was very low – I could have started a business and they’d have wheeled me out on TV shows,” he says. “They wouldn’t have cared about the metrics.”

When asked if he could have achieved more, he points out that hindsight illuminates the places where you wasted time. He adds that if was more self-believing or more aggressive or had higher conviction in the things that ended up going well then he could’ve done more and that focusing too much on regret reduces the lesson.

He focuses on how much he is performing today compared to how much he was performing yesterday – how he’s speaking up, selling and treating people.

“I’m hearing ‘sacrifice’, ‘should be doing’, ‘holidays’ – all society’s expectations,” he says when asked about whether he lost out by starting a business at a young age. “On balance, you can’t have everything in life – it was a choice I made.”

If he were to say he sacrificed in one area, it would be his family relationships. When he dropped out of university after the first lecture and said he was going to start a business, his family, particularly his mum who comes from Africa and has a first generation immigrant perspective on education, said she’ll never speak to you again, his family will never speak to him again. “Families want the same thing for you but disagree on the path of how to get there” he says.

#2 – It’s okay to hire employees in the early stages

When he started his business, Social Chain, Steven employed someone “almost straight away”. He says that there are a lot of people, like himself, who wanted to work for free for experience or for $500 a month. He just had to find the “hungry young kids” who wanted to hustle with him.

Steven’s first employee was seven years older than him, on Jobseekers’ Allowance and was invested in Steven’s vision for Social Chain.

>See also: Hiring your first employee as a small business

#3 – Don’t get down on yourself for having issues with covering payroll – he had them too

Steven had his fair share of payday issues with Social Chain – more than ten times by his accounts – partially because the company was growing very quickly. “There were many anxiety-riddled months where on payday I didn’t have enough in the bank to cover payroll,” he says. Clients wouldn’t pay in the same timeframe that the company had to pay staff.

He tells a story of a client he was speaking to on stage who had an upcoming deal with Social Chain and signed an e-contract early. “I’m at bar with them – I need to get someone to sign the contract on my phone in next 3-4 hours. A couple more drinks, a couple more drinks, then one of the CEOs said, ‘I’ll sign it now.’ This was an hour before people were expecting to be paid” he recalls. He never missed payroll once. Like many entrepreneurs, if Steven is having payroll problems, he wouldn’t pay myself. In fact, he didn’t pay himself for a year during the pandemic.

The takeaway is that entrepreneurs shouldn’t get discouraged if they’re having payroll issues: “[You] can think it’s proof of your own inadequacy when you can’t solve the problem” he says.

#4 – You can recover from a bad credit score

It may be hard to be believe that Steven wasn’t so hot with credit before now. When he went to university, he didn’t know what credit was. He got four credit cards and crashed his credit score. No one would even put his name on a business bank account, so he had to learn how to live personally and in business with no credit or debt. He had to get £200 credit builder card and recover his credit score gradually. His credit has only been good for about a year and a half now.

>See also: How to improve your business credit score

#5 – Stay grounded

If you’re insecure, a lot of money will bring out the dark side of you, says Steven. “I don’t have a different perspective of myself than when I did when I was 18, though I am more aware of skills and weaknesses.”

#6 – Personal branding is key

Speaking of which, Steven is a big believer in personal branding. “If I was to do nothing else but recruitment, winning business from clients, etc – it would be personal branding. It’s the most effective tool for scaling growth, hiring people, getting press, putting perspective into the world.”

He used to pay to speak on stage but once his profile grew, that reversed: “People buy from people – that’s the adage, that’s the fundamental truth” he adds.

He started doing personal branding six or seven years ago, but it’s really grown in the past three months (no doubt thanks to the recognition he’s getting from Dragons’ Den).

“You can be a magnet or a door-to-door salesman,” he says. “If you build a big castle and advertise yourself, people will come to you.”

In later years, most of Steven’s selling happened on stage. He tends to think of it in terms of the investment of one hour and where it will get the greatest return. It could be one hour spent with the global team at Coca-Cola or one hour being on stage.

He recommends LinkedIn as a worthwhile platform for new business as the reach per dollar spent is highest: “Posting an article gets a tremendous amount of reach from LinkedIn for the effort put in.”

#7 – Heed the four key drivers of B2B revenue

Social Chain didn’t have an outbound sales team until Steven left the company. He used his four key revenue drivers in B2B businesses instead:

- Speaking on stage (70 per cent of revenue)

- Personal branding of himself and one or two other executives

- Use LinkedIn and social media – “We were very obsessive about using social media as a business tool”

- Newspaper coverage (around 5 per cent of revenue)

#8 – Preparation + luck = success

Timing was a major factor in Steven’s success. On the relationship between preparation and luck, he says: “Think of it as a wave coming into shore. Then you have to pick a surfboard and hope it brings you into shore.”