The Federation of Small Businesses (FSB) is calling for Chancellor Rishi Sunak to swerve “damaging” tax hikes ahead of the Spring Statement on March 23.

The small business body has written to the government outlining what it wants to see in the upcoming announcement. It comes at a time where businesses are worried about soaring energy costs, supply chain disruption and labour shortages.

Martin McTague, the FSB’s national chairman, wants the Spring Statement to be a “rallying point” for businesses.

He also wants to see a move away from the super deduction tax, which he calls an “eye-wateringly expensive” tax break for large corporates. Instead, he says they should “prioritise reduction of government-imposed overheads to free up funds for investment at the local level.”

Other items from the FSB’s costed wish list include:

- Increasing the Employment Allowance to £5,000

- Taking an additional 200,000 community small businesses in levelling up target areas out of the business rates system by increasing the rateable value ceiling for small business rates relief to £25,000, and extending a one-year relief on business rates increases linked to property investments in plant and machinery

- Extending support with energy costs being allocated via the council tax system to micro businesses via the business rates system, and launching a Help To Green initiative to spur on-site renewable generation

- Delivering on pledges to end the UK’s poor payment culture by making Audit Committees directly responsible for ensuring best practice within supply chains

- Expanding and making permanent a statutory sick pay rebate for small firms whilst continuing with incentives in England to take on apprentices and T Level placements

- Widening eligibility for the Help To Grow Digital and Management initiatives to the 750,000 small firms currently excluded from them

- Simplifying the R&D tax credit system to make it more accessible for small businesses without having to use paid intermediaries

>See also: Most small firms not eligible for Help to Grow: Management scheme

The FSB also wants the government to build on the success of the Refugee Entrepreneurship Pilot Programme. Existing research shows that migrants who are seeking asylum are considerably more likely to start an enterprise than other groups. They want Universal Credit to be reformed so that it’s more supportive for entrepreneurs with no start-up capital.

Tax rises ahead

Sunak is set to confirm the increase National Insurance and dividend tax in his Spring Statement. There’s also word that he may drop research and development (R&D) tax incentive for small research-based businesses in favour of supporting larger firms.

>See also: Sunak eyes reining in small business R&D tax credits

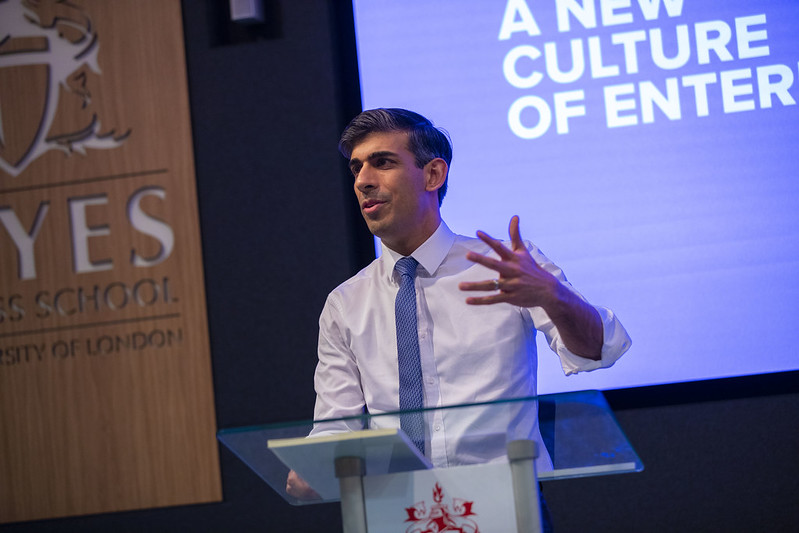

FSB national chair Martin McTague said: “The Chancellor has a choice: plough on with damaging tax hikes or take steps to protect the most fragile and empower small firms to deliver his ‘culture of enterprise’ vision.

“He rightly talks about the need to invest in capital, people and ideas. However, that investment cannot happen so long as surging operating costs are depleting cash reserves and disposable incomes. Pulling the rug from under small research-intensive firms with the removal of incentives would make a bad situation worse.

“The time to deliver a low tax, high investment, dynamic economy is now, not later in the political cycle. The Chancellor cannot control the wholesale price of gas and oil, but he can control tax policy.”