Making Tax Digital (MTD) for VAT is new HMRC legislation that forms part of a wider plan to eventually digitise all tax for UK businesses. All VAT-registered businesses with VAT-able sales above the annual VAT threshold (currently £85,000) are now required by law to keep digital records and file digital VAT returns through MTD-compatible software.

The majority of businesses need to do this for VAT periods that started on or after 1st April 2019 and around a million UK businesses are required to submit their VAT returns under the new system.

When you run your own business, changes to tax legislation can often seem intimidating but complying with Making Tax Digital needn’t feel that way. This checklist walks you through how to get up to speed with the new rules and how you and your business can benefit from the new system.

Register for MTD with HMRC

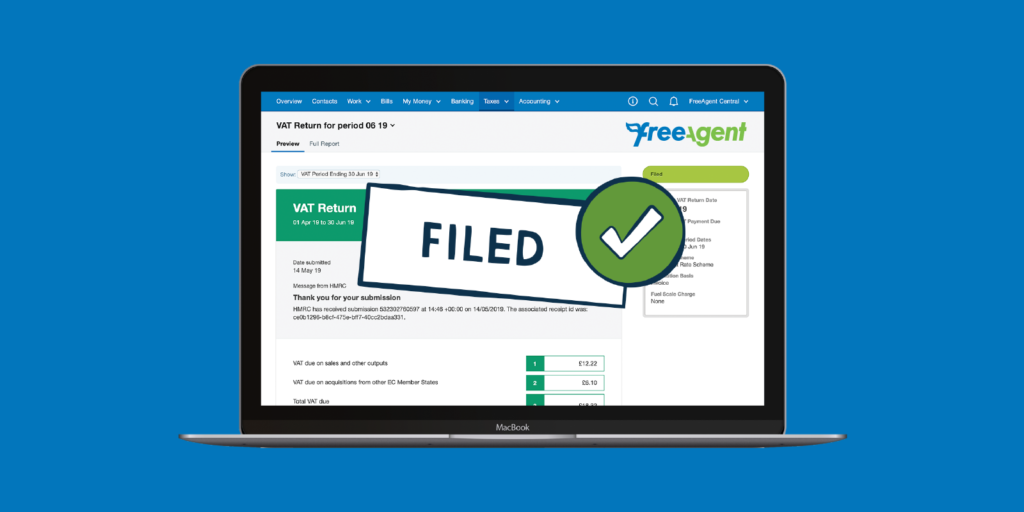

If you haven’t already done so, you’ll need to register for MTD with HMRC as you won’t be registered automatically. You can do this by visiting HMRC’s website. Once you’ve done this, you’ll need to connect your HMRC account to your chosen software. Be aware that it can take up to a week for HMRC to process your MTD registration, so be sure to allow plenty of time.

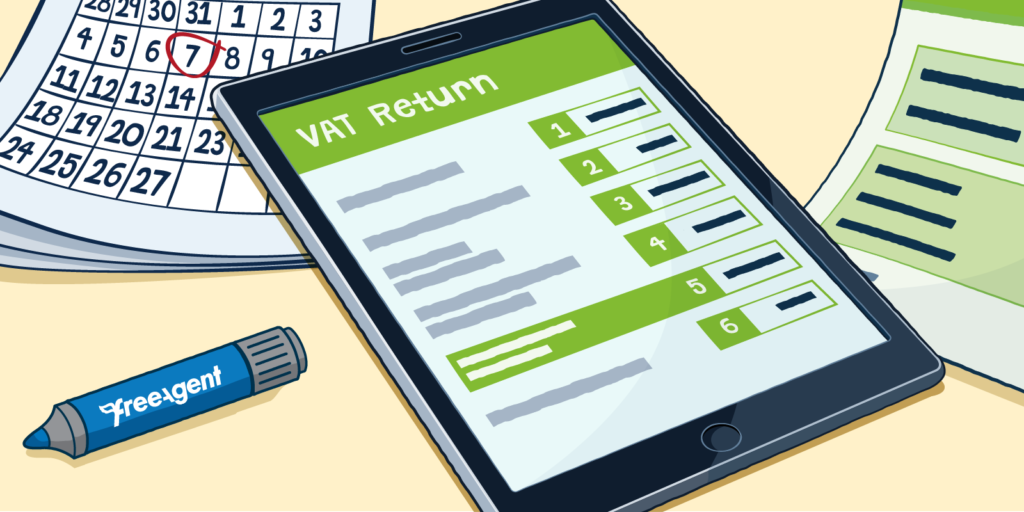

Find the right software

In order to comply with HMRC’s new VAT filing rules it’s essential to sign up to MTD-compatible software, such as FreeAgent. With years of experience of helping business owners submit VAT returns digitally, FreeAgent has already enabled thousands of businesses to do so under the new Making Tax Digital system.

Don’t be complacent

As the new legislation is now in force for VAT-registered businesses with VATable sales above £85,000, it’s important to make an effort to comply and switch to the new VAT filing system. To help businesses make this transition, HMRC has stated it will be lenient in its approach towards issuing penalties. In August 2019, Jim Harra, deputy chief executive of HMRC, said: “Our ambition is to help businesses to get it right, not to penalise them.”

Remember that you still need to pay your VAT bill on time!

At the moment, the consequences of missing a VAT payment are the same as they were in the old system, so once you’ve filed your digital VAT return through your software, be sure to pay your VAT bill on time.

Enjoy the long-term business benefits

While the new digital system may seem like a lot of work right now, this short-term pain really will lead to long-term gains. Getting started today will mean you’ll soon be fully compliant (avoiding the wrath of the taxman) and you’ll be able to file your VAT returns far more quickly and efficiently. Keeping your accounts up to date in your accounting software should also give you clearer visibility of how your business is performing, which will help you make well-informed decisions in the future.

Look at the bigger MTD picture

HMRC’s VAT change is just the first step in the move towards the full digitisation of tax in the UK. The government plans to widen the legislation to all other business taxes such as income tax and National Insurance. If MTD for VAT doesn’t affect you yet, stay one step ahead by managing your accounts with accounting software and you’ll be prepared when future digital tax rollouts come into force.

A FREE 30-day trial with no credit card required

Get ready for HMRC’s new VAT filing process with FreeAgent. Check out these handy FreeAgent guides for more information and try the MTD-compatible software for yourself by signing up for a 30-day free trial.