A quarter (24pc) of SMEs are reporting that late payments are a bigger issue than they were a year ago.

This figure comes from the latest Independent Chartered Accountants of England and Wales (ICAEW) Business Confidence Monitor, which shows some worrying trends. Six out of nine industries (property, business services, manufacturing & engineering, construction, retail & wholesale and banking, finance and insurance) say that the problem of late payments is growing.

Tim Gardiner, finance director at Panton McLeod Limited, says that large corporates are still notorious late payers, particularly in the construction industry:

“A large part of the problem is where companies have complicated processes for the submission of invoices or claims for payment, combined with a lack of clarity as to who is the contracting company in relation to large scale projects. This arises from intermediaries acting on behalf of utility companies in my experience.”

Around two fifths of businesses report that regulatory requirements and customer demand are also rising problems.

Business confidence is still down

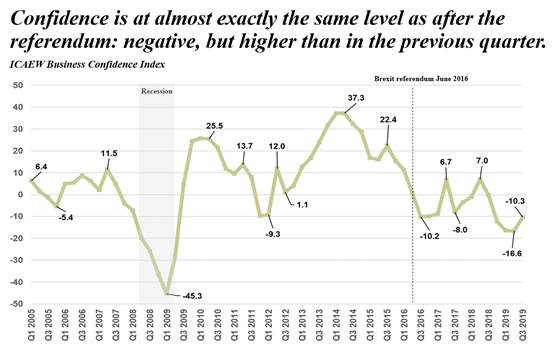

ICAEW’s results show that confidence remains negative this quarter at -10.3. However, this is still higher than Q2 2019 when it was -16.6.

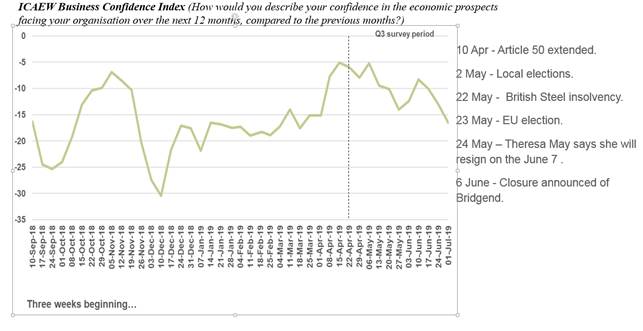

Events like British Steel’s insolvency, evidence of a global shutdown and international political anxieties have contributed to the downward trend in confidence. It’s reversed the predicted gains after Q2 from the extension of Article 50 in April, bringing confidence down to almost the same level as it was in the quarter after the Brexit referendum vote.

GDP growth is expected to be very weak in the second and third quarters of 2019. The Confidence Index hints that the UK could only see growth of only 0.1pc in Q2 and 0.2pc in Q3.

There was an uplift in Q1 as businesses increased stock to prepare for a no-deal Brexit on 31st March, but low confidence signals that there will be weak growth in Q2 and Q3.

What about growth and confidence in future?

ICAEW point out that announcements of increases in Government spending coupled with tax cuts portray an optimistic picture, but these measures may not come for some time yet.

They also say that we can’t ignore the upcoming Brexit deadline and the possibility of a no-deal, a general election – or both.