Ever dreamed of selling on eBay full-time?

It’ll take a hefty amount of work – successful sellers flog more than a few pieces of tat from around the house.

An astonishing 40 per cent of home businesses actually don’t have their own website, either – they opt for selling on eBay and/or Amazon. It makes sense: you have people searching for items that they wouldn’t normally find in the shops and you’ve got a ready-made, diverse marketplace.

But you’ll have to treat it as a bona fide business, with licences, tax and a solid customer feedback score.

If you’re baffled by eBay selling, read on for some tips on how to get going. We also chat with two UK entrepreneurs who have made their eBay selling a success.

How do I start setting up a business on eBay?

Firstly, Think about a business name, acquiring a licence (check your local government laws) and compiling a business plan.

When those are in place, you’ve got two account options on sign-up: regular and business. Having a business account means that you can use your company name and branding in all of your communications with customers. You’re also eligible to apply for a discount on eBay fees.

To register as a business, click the ‘create a business account’ link at the top of the registration. You’ll need a UK postal address or a landline telephone number as well as a bank account that accepts direct debit instructions.

It’s also worth setting up a PayPal account if you don’t have one already. It’ll make it easier for buyers to pay you and you can send PayPal invoices through eBay.

Your first auction

Creating that first auction is easy. Take a few photos (during daylight, preferably) and upload them. Make sure you have photos at different angles too as buyers will want a proper idea of the item’s condition.

On that note, you should get as much detail in the description as you can. Be clear about any faults like ‘loose stitching on right leg’ or ‘small scratches’. Include the colour size and brand as well as the opening price too, shipping prices and whether or not you’ll accept returns.

This will save a lot of miscommunication and hassle when it comes to customer feedback.

From there, it’s always customer first – that way, you can build up your feedback score and in turn, your customer’s trust in you.

A customer score of ten will earn you a yellow star and as you gain more, this will progress until you reach a silver shooting star for a score of 1,000,000 or more.

To get to that score, make sure you ship quickly and safely, respond to customer feedback (positive and negative) as well as asking for customer feedback after their item’s delivered. If you don’t have time to customise a message then you can use eBay’s automated feedback reminder.

Opening an eBay store

After that, you might want to consider opening an eBay store as it’ll be easier to run your business and sell items than it would be putting stuff up as a standard business seller.

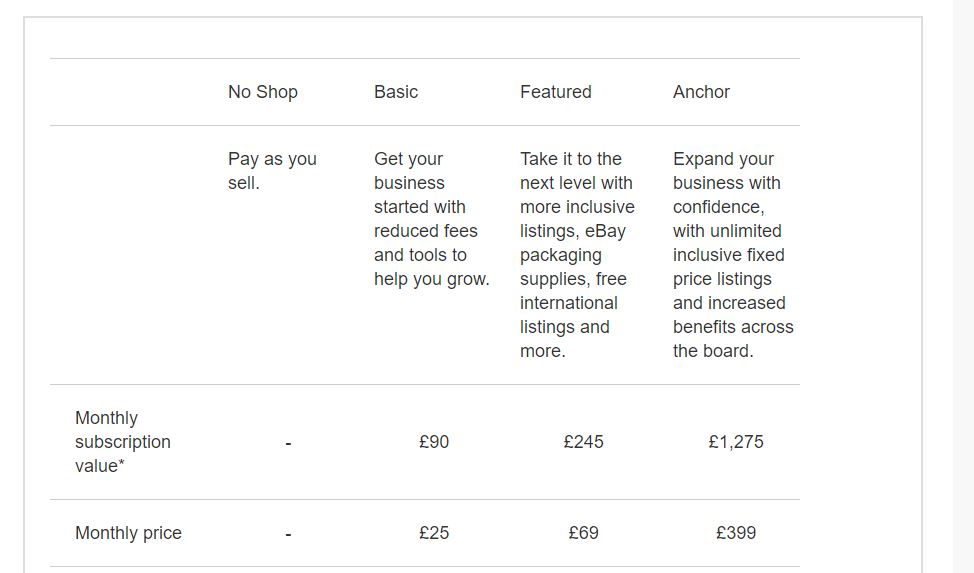

There are three types of subscription for UK sellers: basic, featured and anchor. These cost £25, £69 and £399 a month respectively.

You’ll need to meet certain standards if you want to climb up the seller rankings. For a featured shop you need to you must have a seller level of ‘above standard’ or ‘eBay top-rated seller’.

For an anchor shop, you must have a seller level of ‘above standard’ or ‘eBay top-rated seller’.

From there, you can personalise your shop. You can do this through the Quick Shop Setup which will be available to you immediately after you subscribe to your shop.

After you’ve done the Setup you can use the Quick Shop Tune Up. Find it through My eBay > My Subscriptions > Manage My Shop > Start Quick Shop Tune Up.

On Tuneup you are able to edit the following features:

- Display settings (billboard image, shop logo, shop description)

- Theme and display (shop theme, left navigation bar settings, listing frame, eBay header style, featured items)

- Shop categories and sub-categories (go to My eBay > Account > Manage my Shop > Shop Categories > Add category to get started – you can change categories as many times as you like)

Both Setup and Tune Up give you marketing recommendations that are popular with other sellers.

If you’re new, there may be listing and selling allowances to monitor your practices. They are accounts-based, category-based and item-based. If you want to increase any of your allowances, contact eBay and they may grant them to you. If they don’t, try again 30 days later. You can check your allowances in My eBay > Selling.

Not sold yet?

These tips will help you in setting up a business on eBay, but for the more established eBay entrepreneur, we speak to two thriving businesses to find out how it’s done.

Craig Moore, founder of Staffordshire Silicones

Craig started selling glitter grout after spotting a gap in the market, using eBay as an inexpensive and professional-looking way of selling his wares.

The idea for the business Staffordshire Silicones and the main product came about after a sales trip to a tile fair in Spain with the company I used to work for.

We were each asked to go about the fair, find new and exciting products then report them back to the managing director to assess if they would be viable for sales in the UK. I found a small company which had samples of sparkle grout in one colour (grey) and thought it was an amazing idea and excitedly reported it back. My boss told me that it was a silly idea and I had wasted my time!

A little peeved, I ordered samples for myself anyway (subject to much laughter and stick from the rest of the team) – I wanted to see how people in the UK reacted to this product.

“My boss told me that it was a silly idea and I had wasted my time!”

It started to sell, and I tried to order more but the factory that I had the samples from had gone out of business, so I did some research and produced my own, adding more colours and variations as I grew.

My target audience at first was independent tile shops and builders’ merchants up and down the UK but I didn’t have much success. I decided to stick to the end user. Through YouTube, Facebook and Twitter, I started to gain a steady following.

eBay was the very first platform we sold our products on. It was very easy to get sales quickly due to its huge market presence and Google front page exposure – all with little financial outlay.

It’s also very user-friendly, I still had a full-time job and was working 50/60 hour weeks so I could collate the eBay sales and messages from customers and spend a few hours every other evening responding and sending out orders. eBay has been an amazing marketplace for me.

After around two years juggling my full-time job and selling products on eBay, I was, without exaggeration, working 12-16-hour days every single day and something had to give. I loved selling products online but also loved the great salary I was earning during my full-time job as a sales representative.

I was burned out and drained, so I had to make a decision. I plucked up the courage to quit my job and try to push the business as far as I could working for myself. I always thought that I was young and talented enough to get myself a decent job again if it didn’t work out – I gave it 12 months to see if I could earn a decent living and I’m glad to say that I’m still doing it ten years later!

How is eBay as a selling platform?

I think the pros of using eBay are:

- It’s easy to use with no previous experience needed

- There’s no financial outlay on an expensive website

- Product listings look amazing and professional straight from the off

- You get great Google ranking for product and keywords

That said, the biggest downside of eBay is that it can be very one-sided when it comes to feedback or disputes, often siding with the customer without any thought for the seller. I reckon most eBay sellers would say the same.

We believe in good business practices. If a customer received an item that has been broken or lost in the post, we replace it without issue. If there is a fault or they changed their mind, we accept returns and refund without issue. It’s understandable that not everyone will trade like that on eBay, but for the honest sellers it’s one of the most frustrating things about selling on the platform.

To gain extra feedback on eBay, we have tried nearly every trick in the book: free gifts, reminder stickers, discounts. I think the best way to show the customer that you’re a decent company is the honesty that I mentioned before. Unfortunately, things get broken or picking errors occur, but if you mess up then ‘fess up! Hopefully the customer will respect that and leave decent feedback reflecting that.

Our social media presence is huge for our business and a very good way to communicate and share with customers, photos on Facebook, Instagram and Twitter have been amazing marketing for us.

We had a lady in America share one of our posts with the comment, ‘Wow, I never knew glitter grout was a thing’.

It went viral on Facebook and Twitter, with orders coming out of our ears and websites crashing. Social media is amazing for getting free exposure for new products or flash sales that you’re trying to promote.

Greg Barker, founder of Model Railway Emporium

Greg found new value in the trains that he was so fond of as a child, leading him to set up his own eBay model railway shop.

My childhood love of trains was instilled through my grandparents and my dad. I had always been interested, but the interest dwindled as I grew older. When I was 16 and heading into sixth form, I sold all of my own model railways as Xbox and football were more important.

A job wasn’t practical going forward. With £150 of the total, I risked and re-bought some rare items at the time – I managed to buy them off eBay.

I source my stock from a multitude of places, really. A lot of people ring me, I advertise, actively seek source through contacts and sometimes through shops as well.

The name ‘Model Railway Emporium’ was simply a concept that came around to try align my eBay shop with a never ending supply of rare and difficult-to-find items.

Value is what anybody is willing to pay for something. If a business is to be successful, you cannot be a ‘busy fool’. Nobody wants to be the cheapest, selling good quality stock in bulk for the same cash reward as the person who sells fewer, but more expensive, goods.

eBay is ‘like a disease’

eBay is like a disease, but a positive one. Once you have the bug you don’t want to stop. I’ve sold over 15,000 items since 2012 and I am still as hungry as the day I started.

It’s easy to use and has worldwide reach, so you can earn while you’re asleep or on holiday.

The fees appear expensive, but I believe that comes with the territory. There are also a lot of rules to abide by and your feedback score is precious.

eBay and Paypal fees are roughly ten and four per cent respectively. They need to be built into the costs for running anything, no matter how small or large. The site changes rules all the time. That influences the amount of fees you pay sometimes when it correlates with your ‘seller rating’, that side of things is frustrating.

For example, I missed a few hoops of theirs this month and it cost me £200 more in fees.

Your customer is your most valuable asset. Whether you truly value them or not, you must make them feel valued and communicate on a personal level. Take the time to message them and reply to your queries.

“I’ve sold over 15,000 items since 2012 and I am still as hungry as the day I started”

If you encounter any problems, just bite the bullet and sort them. Do not ignore them. It helps to put yourself in their shoes. You have to approach each customer, making them feel valuable and that they are not simply a number – make it memorable.

For what I do, Facebook works and Instagram doesn’t. You can direct market your own business with flyers and business cards. There are probably a thousand strings to my bow now; that’s why the company turns over such an impressive amount of money (above a quarter of a million each year).