If you’re considering starting a business involved in importing or exporting products, you’ll need to know about commodity codes and HS categories. These are used to classify goods for import and export, to make sure they’re moved safely and in compliance with customs, tax and duty regulations.

In this guide we’ll look at when and why commodity codes are used, what they look like, and how to find the right one for your needs.

Here’s all you need to know about commodity codes.

>See also: EU import changes – what’s changing from January 1

What are commodity codes?

A commodity code provides details of the goods you’re importing or exporting, such as what they are, what they’re made of, how they’re used and even how they’re packaged. This information is used for tracking imports into the country, and making sure that hazardous items are properly treated, but also for calculating import duty and VAT.

To import anything into the UK, you’ll need to make sure the right commodity code is included in its customs declaration. If you can’t correctly match your goods to the right code, you’ll not only be be paying the wrong customs duties but also risking serious legal consequences.

Possible consequences of using the wrong commodity code

- Having to pay top-up taxes (import VAT and duties)

- Having to pay a customs fine

- Having your deliveries delayed to frustrated customers

- Having your goods seized

You can find the correct commodity code using the online trade tariff lookup tool. Alternatively, you can get specific advice from HMRC, or use the Government-issued product classification guides to help.

Why you need to know about commodity codes

Commodity codes have a number of uses in import and export businesses. They’re used when completing paperwork for customs declarations and can influence the amount of tax and duty you pay to import or export a product. Using the correct commodity code is also important to make sure you’re following any relevant legal or safety regulations when importing products which might be dangerous or restricted.

Structure of the code post Brexit

Commodity codes now have to be included in the customs declaration that you will need to provide to clear any goods through UK or EU customs. This will make clear how much taxes – VAT and tariffs – you should be paying.

The UK is using the standard global 10-digit format, as does the EU, which can add 4-digit codes required to apply certain measures, such as trade defence or certain suspensions.

Commodity codes are made up with a range of digits that identify a particular product. They specify the type of product, materials used and the production method as follows:

- HS code digits: It starts with the global standard – Harmonised System, or 10-digit HS code. The UK has used this format since January 2021

- EU additional digits: The EU has added up to a further four – making potentially 14 in total. These extra EU numbers are: 2 digits CN heading (Combined Nomenclature); 2 digits TARIC (Integrated Tariff of the European Communities)

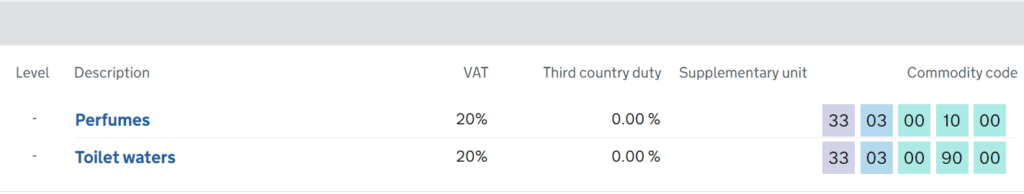

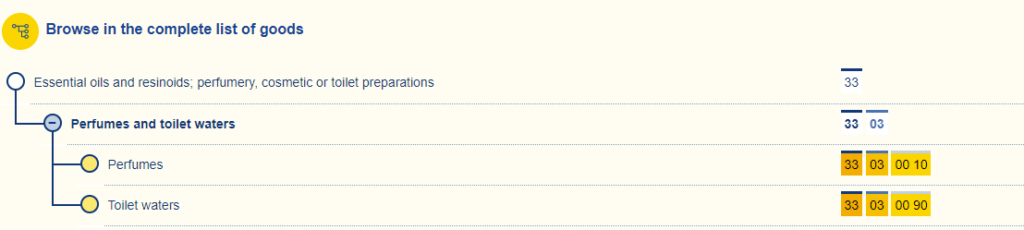

For example, if you search for the commodity code for “perfume” on the UK trade tariff search engine, the UK HS code is 3303001000.

You can find the EU commodity code through the Access2Markets online service, which should match in most cases.

Pro tip: The Access2Markets is geo-blocked if you’re in Great Britain and the country you enter in the “country from” field is an EU member state; although it’s not blocked if the “country from” is the UK.

It is possible that the EU and UK do not classify every item the same. However, as both are members of the World Customs Organisation, they apply the Harmonised System, which is expressly designed to achieve uniform classification across contracting parties.

Pro tip: If somebody is exporting from the EU then the EU export declaration would only require the EU commodity code to 8-digits. The longer commodity code would be required on the UK import declaration.

A UK business can use the Access2Markets (with the “country from” being the UK), to obtain a commodity code, truncate it to 8-digits for use on the EU export declaration. Alternatively, you can use the advanced search function on the EU TARIC website and truncate.

So with just a few numbers, the importers and exporters – and every other authority and organisation which handles the products on the way – know exactly what they’re dealing with.

Find your commodity code with the trade tariff look up

- Go to the UK government trade tariff look up page

- Hit Start Now

- Enter the search term you want to use – the dialogue box will automatically populate with common searches to help you

- Suggested commodity codes will appear, starting with the HS chapter and headings to help you narrow it down to the correct category of products

- You can continue to search the suggestions using other information, such as what the item is made of or how it is packaged

- Once you find the correct item type you’ll be shown the HS code, and any important information connected to this code – such as whether or not you need a licence to import or export items under this code.

What happens if you don’t have a commodity code or use an incorrect one?

If you use an incorrect commodity code, you might find that your goods are seized or delayed by customs. You might pay incorrect VAT or duty, and – if you pay too little – could be liable for extra fees and charges.

Some items can only be imported or exported with a licence, such as plants, animals, or anything potentially hazardous. If you try to move these products using an incorrect commodity code, you’ll be breaking the law, and will find yourself in serious legal trouble.

How to find out the right commodity code

Another option, if you can’t find the commodity code you’re looking for, is to ask HMRC for advice on the best fit code for your product. You can contact HMRC using the following email address:

classification.enquiries@hmrc.gsi.gov.uk

HMRC will respond to your email within five working days. The EU member states have various similar tools.

Before you ask for advice

You’ll need to include information about the product you’re planning to import or export, to get advice on the commodity code. Your message should include:

- Company name, if applicable

- Contact name

- Contact details (email address and a contact number)

- The option which best describes your item: agricultural, chemical, textiles or ceramics – including food, drink, plastics, cosmetics, sports equipment, games, toys, clothing, shoes, electrical, mechanical or miscellaneous – including vehicles, optical and measuring devices, machinery, musical instruments, metal, furniture, lighting, paper, printed matter, straw, glass, wood, jewellery

- What the goods are made of (if more than one material, provide a breakdown of materials)

- What the goods are used for

- How the goods work or function

- How the goods are presented or packaged

- Any code you think best fits your goods

- Part of the code if you’ve been able to partially classify it

You should send a separate email for each product you need help with.

>See also: How will Brexit affect my imports and exports? Where to find customs help

How to obtain an EU-wide BTI ruling

In some cases it might be helpful to apply for a BTI – a Binding Tariff Information ruling, to confirm your commodity code. It’s a legal document that confirms the commodity code agreed for the product you’re exporting, so there’s no guesswork involved.

Getting a BTI can be helpful because you’ll have certainty about the commodity code needed for your imports or exports. It doesn’t cost anything to get a BTI ruling, but you may need to pay if there are tests needed, for example, to determine the materials used in your product.

This ruling usually lasts for three years and is legally binding throughout the EU.

The EU operates a centralised EU Customs Trader Portal that all BTI ruling applications have to go through. All processes through this portal are now done electronically and you can find the relevant details and related resources here: European Commission Taxation and Customs Union – BTI

How to apply for a BTI ruling

tariff.classification@hmrc.gov.uk

Use the above email to apply to access the EU Customs Trader Portal if you’re based in Britain, putting “Enrolment EU Central Service” in the subject line, including your EORI number.

You can find out more about the process here.

HMRC will aim to reply to your email within five working days to confirm you’ve been set up to access the EU Central Service and give you the link to access it.

Once you have the link, you’ll need to provide:

- Detailed information about your goods, which can vary depending on your goods

- Brochures, manuals, photographs and samples where appropriate. If you want this information to remain confidential, you must tell HMRC

You can also let HMRC know what you think the commodity code should be.

What happens after you’ve applied

HMRC aims to reply to your application within four months. You’ll be given a legal document informing you of the correct commodity code for your goods and the start date for the period of validity of the information. The document also shows:

- Unique reference number

- The name and address of the holder of the information, legally entitled to use it (decisions are non-transferable)

- Description of the goods (including any specific marks and numbers) to identify your goods at the frontier

- Basis of the legal justification for the decision

However, five countries – including Britain – have their own BTI ruling application sites that you can go through in addition to the EU central service.

Applying for a BTI if you’re in Northern Ireland

Binding Tariff Information decisions can be issued by HMRC to traders or individuals that have an EORI number that starts XI for goods you’re intending to import into or export from:

- Northern Ireland

- any EU member states, if you’re established in Northern Ireland

You can find more information about applying for a BTI decision if you’re based in or exporting to Northern Ireland here.

Why commodity codes are important

Finding the right commodity code is one of the first things you’ll need to do before you can import or export goods. It can be a little complex, but there is help at hand to make sure you get the right code for your business needs. With the resources outlined here, you should be able to find all you need to start getting your import/export business off the ground.

Further resources and guides

Import guide: three essential tips and everything you need to know – Guidance for navigating importing in a post-Brexit world.

Tariffs on goods imported into the UK – How to check the tariff rates that apply to goods you import.

The Border Target Operating Model and how it will affect your business – An explanation of the new rules and processes for food and plant imports that will come into force in 2024

5 things to remember when exporting for the first time – Exploring the key challenges for first-time exporters