News

Tag

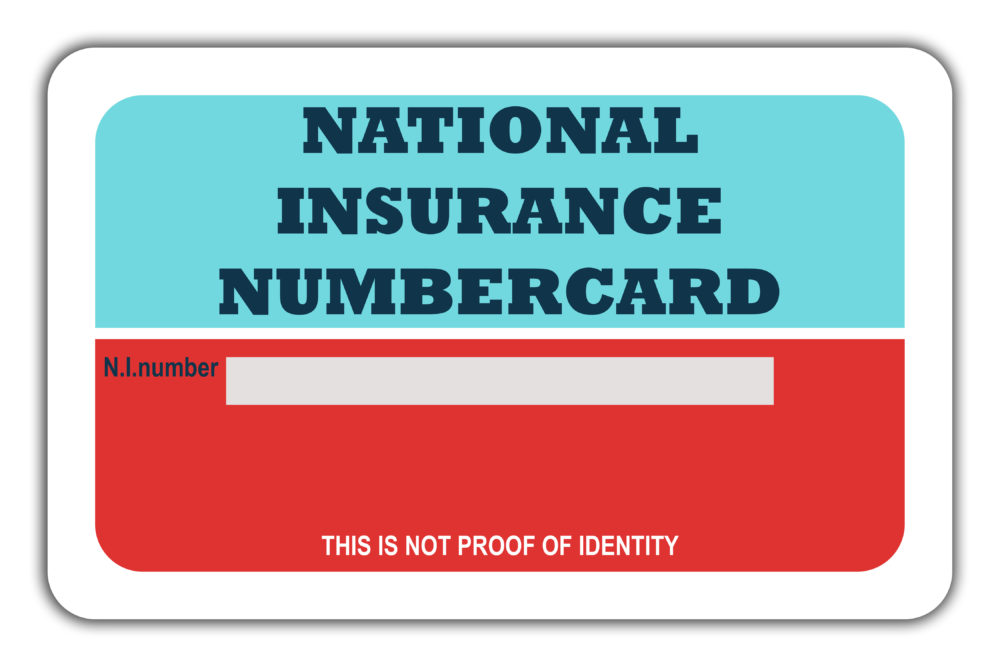

National Insurance

The National Insurance small business archive.

Small Business Insurance

The benefits of national insurance

Tax

Tax dilemmas

Recommended Content

Partner content

What are the benefits of business broadband?

Partner content

How should I select my business broadband provider?

Business Technology

Future-proof your business communications set-up

Business Loans