Accounting

Tag

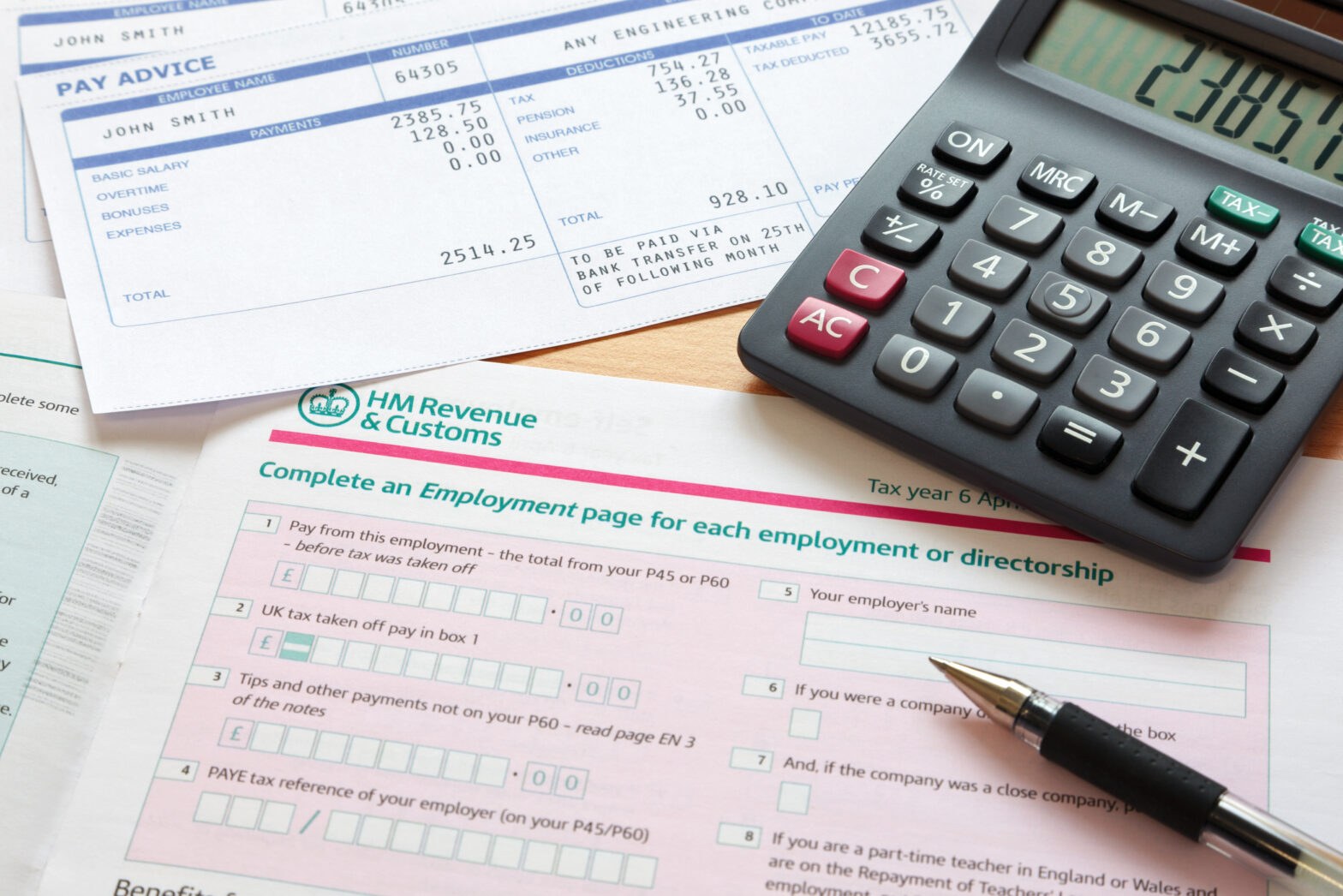

Tax Returns

News and guides on tax returns for UK small businesses.

Recommended Content

Partner content

What are the benefits of business broadband?

Partner content

How should I select my business broadband provider?

Business Technology

Future-proof your business communications set-up

Business Loans