Chasing late payments is a task that small business owners have no time for but are unfortunately forced to deal with.

It’s bad news for small business growth as owners can’t put the time, money and focus on actually developing their company. In some cases, they have to rely on other sources like loans, bank overdrafts and friends and family to even out their finances.

Despite government crackdowns, including the appointment of a Small Business Commissioner, matters don’t seem to be improving.

This often leads to SMEs just writing off debts. And of course, the smaller business usually has the weaker hand, having to juggle late payments with internal issues, relationships and a lack of time.

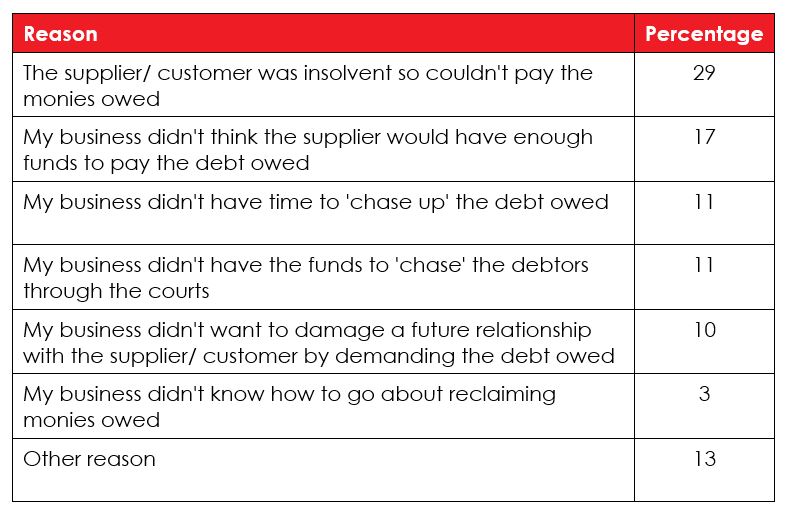

According to Direct Line for Business, these are the main reasons SMEs write off their debts.

One in five businesses suffered an average loss of around £31,300. Worryingly, nine per cent of businesses claim to have written off debts in excess of £100,000.

One in five businesses suffered an average loss of around £31,300. Worryingly, nine per cent of businesses claim to have written off debts in excess of £100,000.

How to protect your business against late payments

Steve Noble, COO at Ultimate Finance, shares some handy tips on how to protect yourself against late payments.

Late payments – it’s the bane of many small business owners’ lives, upheaving growth plans and even putting their company at risk. In fact, research from Dun & Bradstreet shows the average British SME is owed more than £63,800 in late payments, with 11 per cent owed £100,000 or more.

So how does late payment impact small businesses in the UK? FSB research shows a staggering 50,000 UK businesses cease trading as a direct result of this issue. However, it goes further than the health of the company; late payments can have a huge impact personally too.

A study by The Prompt Payment Directory has found late payments are affecting the mental health of SME owners. More than half (52 per cent) blame poor cash flow for panic attacks, anxiety and depression, while 63 per cent state late payments mean they haven’t paid themselves in quite some time.

Clearly the time has come for UK SMEs to fight back against late payments and these simple steps will help to create an environment in which this issue is less likely to have a detrimental impact on your company and your health.

Do your research

Whether you’re a start-up manufacturer securing product placement in a major retailer, or a sole trader plumber being contracted to manage an office site, your first big deal is a cause for celebration. It may be seen as a tipping point for the business – one which will increase cash flow and enable expansion. As such, it’s not uncommon for SMEs to rush into the deal, wanting to begin work as soon as possible. However, this may be to their detriment.

Before entering into contractual agreements, research the prospective partners or customers. Look at how they’ve conducted themselves in the past. In the digital age, there’s nowhere to hide from previous misdemeanours, so if they have a habit of paying suppliers late, you need to know about it.

So, before entering into an agreement, do your homework. Only once you’re confident in the legitimacy of the business should you enter into an agreement with them.

Agree standardised contractual payment terms

Payment terms can depend on a multitude of factors but it’s vital that small businesses only enter into payment terms that are right for their business. Always remember that what’s right for a large enterprise may not suit the needs of a SME.

Look at Carillion for example – before its collapse earlier this year it was a ‘notorious’ late payer which forced suppliers to agree to 120 day payment terms. This may seem perfectly acceptable for large businesses, but this type of black hole in an SME’s cash flow can be crippling.

You should therefore have an honest conversation with the business about the payment terms which will be right for your company and draw up an agreement which will be beneficial for all parties.

Know your customers

It’s a common business analogy that people do business with people, not companies. It’s important that you keep this in mind at all stages of the customer relationship, including invoicing.

Companies may not realise or even consider the impact late payment has on your business if they only ever see the results of your work, rather than the people behind it. It’s easy for them to take your work for granted, rather than truly appreciate your business and the value it adds.

To ensure this isn’t the case, build a relationship with every company you enter an agreement with. If you’re a sole trader, be personable and strike up conversation with the people you meet while on the job.

If you’re a larger SME, task your finance team to help with driving this relationship, ensuring they have the ability to chase payment without being seen as a nuisance. Even check in after an invoice has been sent to check they received it and ask when to expect payment. This works to create an ecosystem of collaboration and respect in which payment terms are much more likely to be adhered to.

Consider your financial options

Although the above steps will go a long way to reducing the likelihood of late payment damaging your business, it would be naïve to assume your company won’t be impacted by this issue at all.

A resilient business is one which has a contingency plan in place for the worst-case scenario which will ensure they continue to thrive. To ensure your business isn’t at risk of closure due to late payment, it’s key that you look into the financial options available if and when payment terms aren’t met. This can come in many forms, from traditional bank loans to invoice finance which could plug the gap left by late payment to allow you to continue going for growth.

It’s even worth looking at debtor protection – it won’t protect against late payments but will support your business if the issue persists.

Unfortunately, the late payment culture in this country isn’t something that can be removed with the wave of a magic wand.

SMEs should therefore do everything they can to ensure they are protecting themselves against falling into the trap felt by so many small businesses across the UK. This will then ensure they can continue to thrive and reach their full potential, rather than watching their company spiral out of control due to an avoidable cash flow black hole caused by late payment.

The extent of the problem

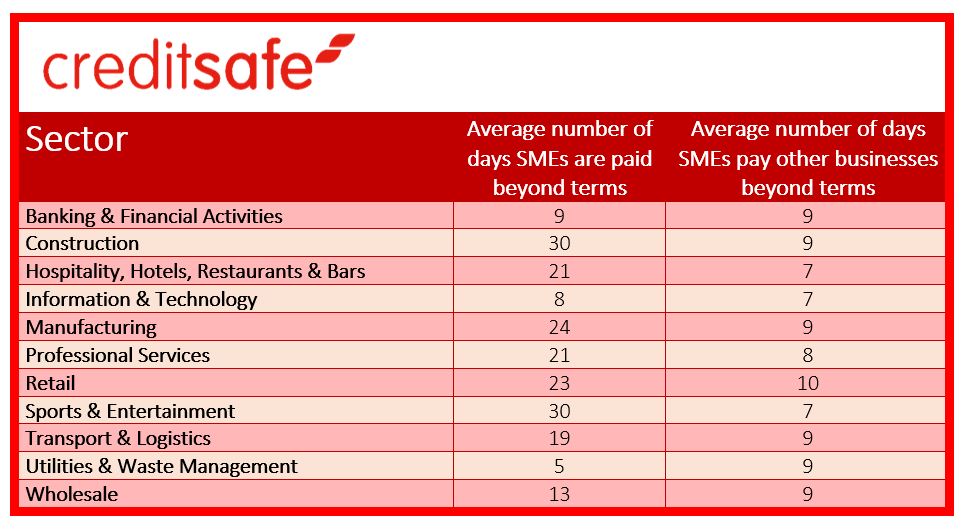

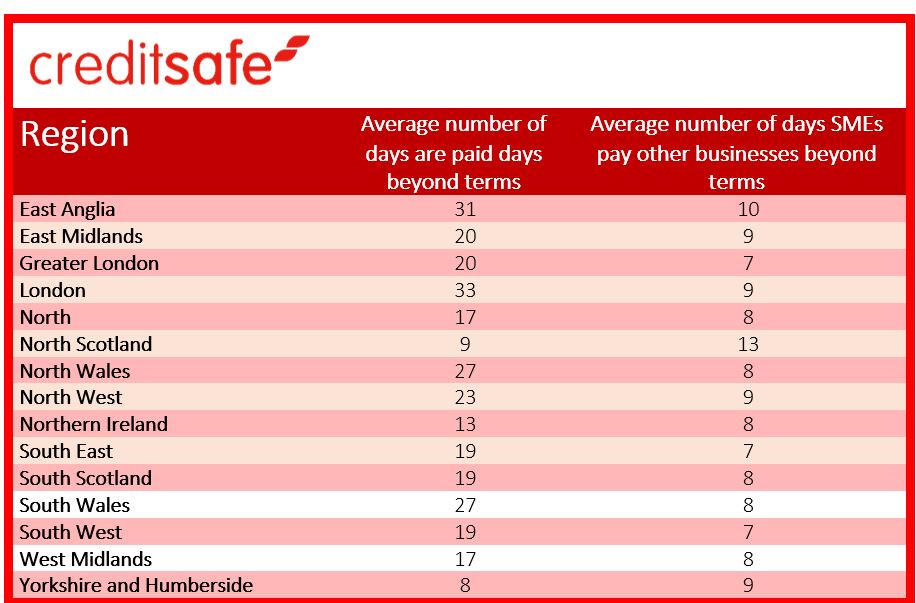

Creditsafe have analysed SME invoice activity from the past 12 months to examine how UK SMEs are affected by late payments.

The tables below will give you more of an idea about how SMEs are affected by sector and region.

Chris Robertson, UK CEO of Creditsafe, comments on the findings.

It’s clear from our data that there’s a major imbalance in payments to and from SMEs and that small businesses are behaving much better than their counterparts when it comes to paying invoices in a timely manner.

It takes companies on average more than twice as many days beyond terms (DBT) to pay SMEs, than it takes SMEs to pay their own invoices. This can have a significant and damaging effect on the cash flow of small businesses, leaving them to wait for payments for up to a month after the agreed invoice terms.

When breaking the data down by sector, it’s hardly surprising to see that the construction industry is one of the worst affected, receiving payments 30 days beyond terms.

The collapse of Carillion exposed how suppliers are often under extreme financial pressure due to unfair payment practices. The sports and entertainment sector is also ridden with payments a month late, while SMEs in the utilities, IT and banking sectors got off lightly with DBTs of five, eight and nine, respectively.

Our data also shows that the issue of late payments is particularly severe for SMEs in London, with an average DBT of 33. It’s evident that the problem is also affecting small businesses in rural areas, where East Anglia has an average DBT of 31 and North Wales 27.

“The collapse of Carillion exposed how suppliers are often under extreme financial pressure due to unfair payment practices”

SMEs are often described as the lifeblood of our economy and it is the responsibility of all businesses ensure they are not being put under undue financial pressure because of poor payment practices.

The consequences of late payments

Not only are late payments a nuisance, but they can have a profoundly negative impact on a small business owner’s wellbeing.

Adam Tavener of Alternative Business Funding explains more.

How our cash flow was affected by late payments

We speak to three small business owners who have all dealt with chasing late payments.

Rebecca Todd, owner of Social Vine

Rebecca hadn’t long been running her business when she agreed to work with a lesser-known company with an opportunity that soon went awry.

My business helps independent companies in the hospitality and tourism sector with their social media marketing strategies. I help owners and teams develop marketing strategies to build their business and reputation online.

I deal with late payments every month, I don’t mind seven days or a justifiable reason if the client speaks to me in advance of the payment being late.

Luckily, my cash flow has not changed due to late payments.

The most common excuse is the person who deals with the payments isn’t in at the moment, but it will be processed. Or there’s the age-old, ‘Sorry, I forgot’.

Astonishingly, the worst excuse was, ‘I’ve broken up from my boyfriend, so I can’t pay anyone.’

Worst case scenario

The particular case was a client for whom I did not have a contract or service-level agreement. The reason for this was that, honestly, I didn’t know what they were. As a new business owner people don’t teach you these things.

The business in question knew my vulnerability and naivety when it came to running a business. Prior to the working relationship we had, we shared a co-working space where we discussed these things. They approached me to create a strategic marketing plan for them, which I did. I requested they paid me in advance, which – may I add – was two weeks late.

They then asked me to manage their social media accounts and we agreed on a set fee every month. We spoke about continuing this agreement for several months. This started in October 2017 and ended in April 2018.

Although a contract was not in place they knew my requirement was one month in advance, which they adhered to until January, when I received no payment.

“The business in question knew my vulnerability and naivety when it came to running a business”

I chased and chased this throughout January, later to reveal that I was not to deal with the owner any more, but their newly-appointed manager. The owner was now too busy focusing on PR. This continued until the end of January (bear in mind they hadn’t paid me since the beginning of December). It was becoming tiresome constantly chasing money, so I decided to call the owner.

The response was abrupt, and I was then informed the payment terms were now 30 days. In my naivety, I didn’t put up a fight and received the long-awaited payment at the end of February – two months late! I then received February and March’s payments late and April’s payment still hasn’t been paid.

I’ve been messaging the manager for the final payment since the due date in May. I was emailed and told they had misplaced the invoice and it was not seen, even though my app showed it was read at the beginning of May. Then the staff member who dealt with it was on holiday for one month.

They told me that the payment was going to be chased up, then that someone was going to call me regarding the payment. The final email I sent them threatening further action resulted in an auto-response to tell me the manager had now left the company. When I emailed another staff member they said, ‘I’m not the middleman, I’ll pass this on’. Those famous last words.

I finally received a message from the owner telling me it was being processed and blaming the manager who had left.

The chase

I’d advise all new business owners to get something written in place, be it a contract or agreement, don’t leave yourself wide open to being a doormat. Download an app that notifies you when the client has read and received the invoice too. Finally, never leave things as long as I did.

The most effective way I have found to chase late payments – though this may be different for everyone – is the more personal WhatsApp message or text reminder. Just say, ‘Hey, hope all is well. I sent invoice over to you, can you confirm you received it. Drop me a quick message when you have actioned it, I’m chasing up outstanding payments this week. Catch up soon.’

Andrew Dark, co-founder of Custom Planet

Custom Planet is no stranger to late payments. Andrew talks about how you should stand up for yourself.

We usually deal with late payments on a daily basis. There is always a certain percentage of payments that are over 30 days, fewer over 60, fewer again over 90 and if you get over 120 its usually going to be very difficult to get it back. We are constantly chasing!

The most common excuse we get is, ‘We’re just waiting for our customer to pay us and then we will pay you’.

The worst one was probably, ‘I’m driving so can’t pay you right now’ – we called back the next day to be told they’re ‘still driving’. And the next week? ‘Still driving’. This guy was on the longest road trip ever.

Assertiveness

Be upfront from the start on where you stand. We have become stricter over the years; we have had to because we have had so many bad debts.

Make sure you have warning letters standing by too. Employ someone whose job it is to chase payments and keep it separate from sales if possible so you can protect your sales relationships. But most of all, talk to the client.

We are strict to a point, but if someone honestly has a good reason we always hear them out and try to work out a payment plan (but if you do this make sure they stick to it!)

It’s much easier trying to honestly talk it out than go down the court route. However, you have to be willing to go all the way if people take the mick. We all have bills and wages to pay.

“The worst excuse was probably, ‘I’m driving so can’t pay you right now’ – we called back the next day to be told they’re ‘still driving’. And the next week? ‘Still driving’. This guy was on the longest road trip ever.”

Changing our ways

We have had to change the way we handle cash flow because of late payments. A few times we have had to borrow money to pay wages or our own suppliers due to bad debts. It hasn’t happened recently, I hope due to our new outlook on chasing debt.

In general, we try to build up our cash flow to prepare for the worst.

If you’re struggling with late payments, get tough! If it’s affecting your sleep, your family and your employees you have a responsibility to act fast and make sure you get into a routine of not only collecting payments but paying your own suppliers on time too.

Make a plan and a process, treat it as a separate department. It should be looked at daily and you should have at least a weekly meeting to discuss the progress on older debts and make sure nothing gets out of control.