What did you have for breakfast this morning? A Pepsi AM? A Cosmo yoghurt? Or a glass of juice fresh from your Juicero?

No, you didn’t. You could have – briefly – in 1990, 1999 and 2017. All are spectacular, financially disastrous and reputationally costly product fails. And we’ve only reached breakfast time.

One of the most misleading clichés around is that ‘there is no such thing as a bad idea’. Complete nonsense and tweak anyone on the nose that says it before they do more damage. The world is littered with bad ideas

They come from the big corporate world as brand extensions within category – such as Pepsi introducing a pointless new variant for which the consumer had no need. Or as responses to an internally generated strategy that has forgotten to understand consumers – such as Cosmopolitan’s logical attempt to move into health & nutrition products but with a product for which their brand had no real relevance in a hugely congested category.

However, corporates rarely bet the farm on one product extension — start-ups do.

The Juicero was a $400 machine that squeezed Juicero packets of diced fruits and vegetables. Presumably, the investors that poured $120m into the business must have been fixated by the heady combination of hardware plus monthly subscriptions for the packets. The perfect commercial model. But consumers don’t buy a commercial model, they spend their cash on satisfying a need.

Juicero might have been able to satisfy a basic need for nutrition & taste, but a consumer is rarely one dimensional. In this case, they would have been weighing up convenience (fruit and veg are not difficult to source, so why is a subscription required?); speed (the machine was slower than squeezing by hand); cost ($400 plus subscription – really?) and environmental impact (pre-packed fruit and veg – really really?)

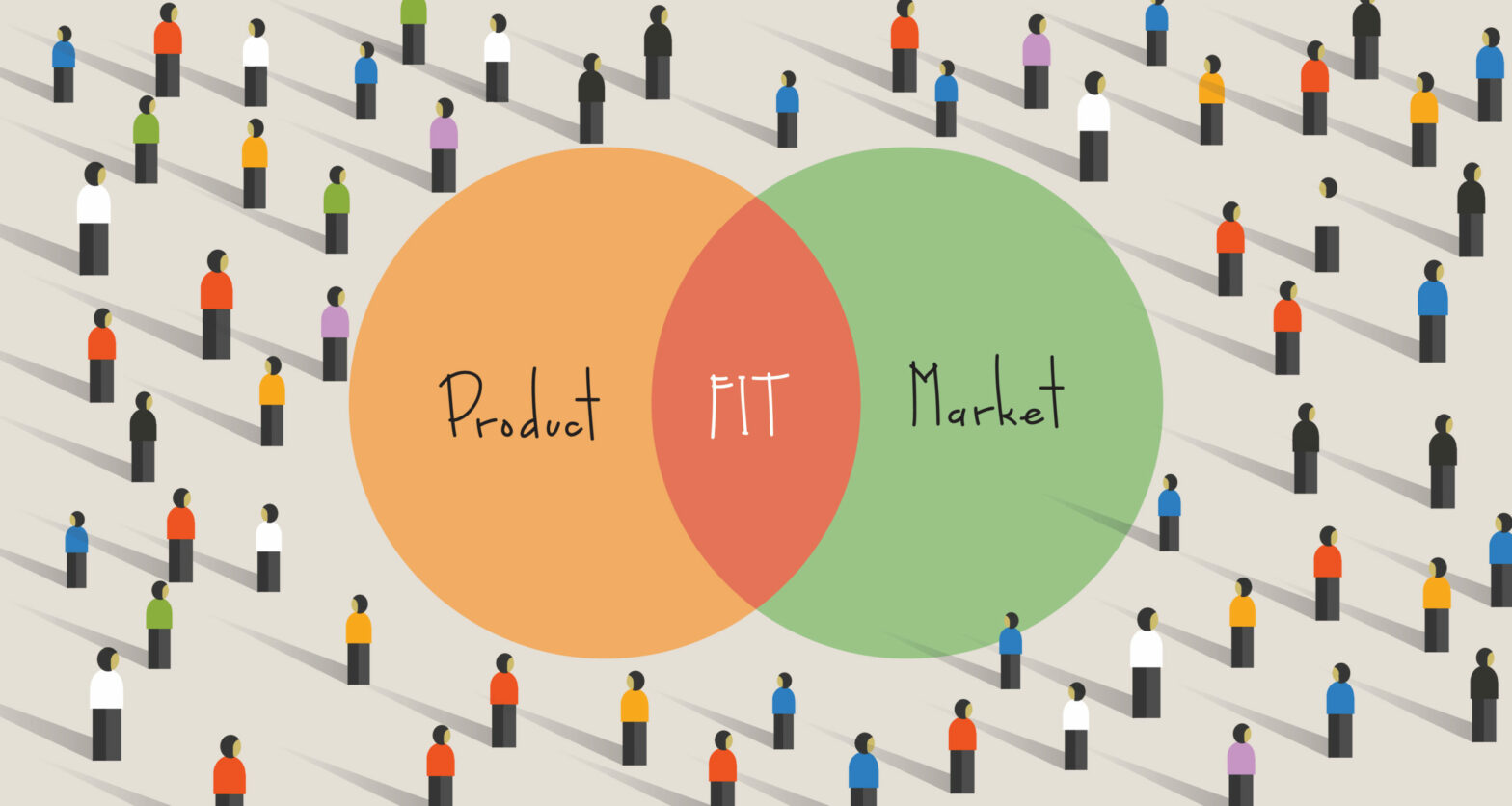

Poor ‘product market’ fit is the top reason that a start-up fails. There are many studies of this and an extensive one put this as the reason for 42% of start-up failures.

When we assess businesses for investment, we obsess about the market need and want to see entrepreneurs that share that obsession. If a start-up has unique insight that has uncovered a market need or has data that proves the demand for their product or service then we are all ears. But just an idea, with no consumer validation, is not going to make it far with us. It’s why we don’t respond well to ‘tech’ businesses.

Business that describe themselves by the tech they use (AI & blockchain being cliched examples), are falling into the trap of being product led not market led. We often look at a tech business and think ‘it’s a great solution desperately in search of a problem to solve’.

So what are the pre-requisites for giving yourself and potential investors confidence to bet on a product or service?

Market need

Get into your consumers’ or clients’ shoes. Think of all the reason they would purchase your product, then spend much more time thinking about all the reasons they wouldn’t. Think about where they would substitute spend to buy your offer. Stop only when you can answer the two critical questions:

- what need is my product or service satisfying?

- why is my solution better than those that exist already?

Don’t fall into the Juicero trap of thinking that there is no product that exists already in the ‘wifi enabled subscription juice’ category, when they should have been thinking about the need for ‘fresh juice’.

Consumer validation

Generally, this is proactive &/or reactive. Maybe a proposition is conceived from consumer insight that describes a gap in the market – ‘I wish there was a way of doing…’. DIY solutions or hacks can be a good sign of this.

Or you might follow the Steve Jobs philosophy that ‘Customers don’t know what they want until you show it to them’. That is fine so long as you do show consumers something and get their feedback. This doesn’t have to be a finished entity — it can be scamps on paper, a model, or a mocked-up website service with nothing behind it. With a price tag. Whatever it takes to get an approximation of the reaction and behaviours you’d get from consumers in the real world.

Market scale

To scale a business, you eventually need a large market with gaps where innovation can thrive – either because it is fragmented, poorly served or high growth. You might have nailed market need and got great consumer validation but only with a small market segment. A good start but you’ll need a plan to transcend the segment and move into the bulk of the market. So don’t just hang out with your ardent fans, understand the differences between the needs in the niche compared to the wider market.

Continuous iteration

The first three pre-requisites have all involved speaking to consumers, gaining quantitative or qualitative data and discerning insight. And the fourth is no different. It is more of the same as your product or service builds out. Constantly testing hypothesise and propositions and responding to feedback.

By the way — get these things right and not only will you and your investors have confidence in your product or service, but you will also have created the fuel for how you describe and communicate your proposition to the market in the language they will respond to. More about that another time.

PS: About that phrase ‘there is no such thing as a bad idea’. It is rubbish in a literal sense, the world is littered with bad ideas and broken dreams that should never have had effort or cash put into them. However, it is bordering on truth. Ideas are never worthless, and all ideas should be considered even if at first sight they seem bonkers. Within any idea lives some insight, some reason why someone thought it interesting and worth discussing. The trick is to retrieve the nuggets of value but then ditch a ‘bad’ idea before it does any damage.

Written by Matthew Cushen, co-founder at Worth Capital

Further reading

7 funding choices when it comes to financing your start-up

How start-ups can qualify and take advantage of EIS and SEIS

3 ways start-ups can create irresistible investment proposals

Start-up valuation – an investor guide to valuing a start-up

7 investor personas: how start-ups can understand their motivations