Making Tax Digital

Tag

Tax

Articles, news and guides on tax issues for UK small businesses.

Making Tax Digital

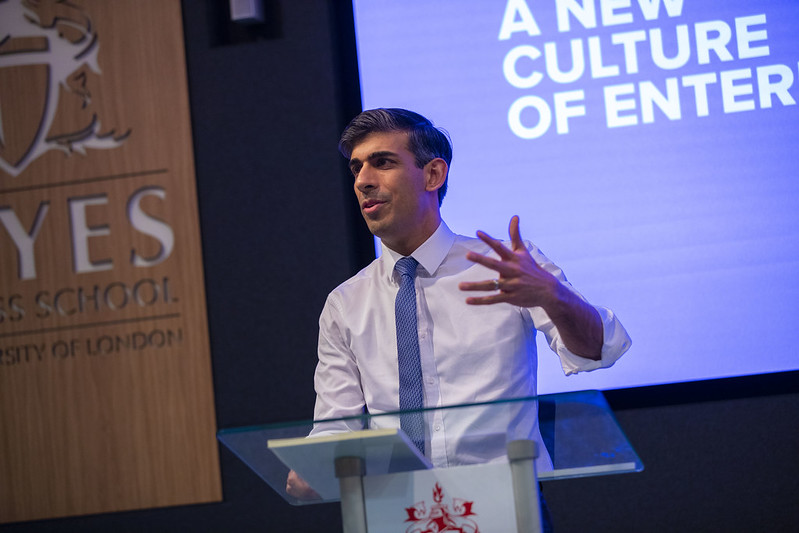

All small businesses to go Making Tax Digital by 2024, Treasury suggests

Recommended Content

Employing & managing staff

The importance of vocational rehabilitation services for SMEs

Partner content

What are the benefits of business broadband?

Partner content

How should I select my business broadband provider?

Business Technology